Oil Trader Vitol Embraces Clean Energy With New Wind Power Fund

Vitol Group, the world’s largest independent oil trader, is launching a new fund to invest in wind farms in Europe, joining a string of oil majors making moves into renewable energy.

The Rotterdam-based trader will invest 200 million euros ($234 million) into offshore and onshore wind farms through its VLC Renewables arm, run by a joint venture together with Low Carbon Ltd. The company is planning to buy minority stakes in projects, working with developers and financial investors.

“We see that challenge facing electricity markets and we are also evolving our business model to adapt to this future,” Simon Hale, investment director at Vitol, said in an interview. “We’re trying to create a platform of scale and we think offshore wind is the best means to achieve that.”

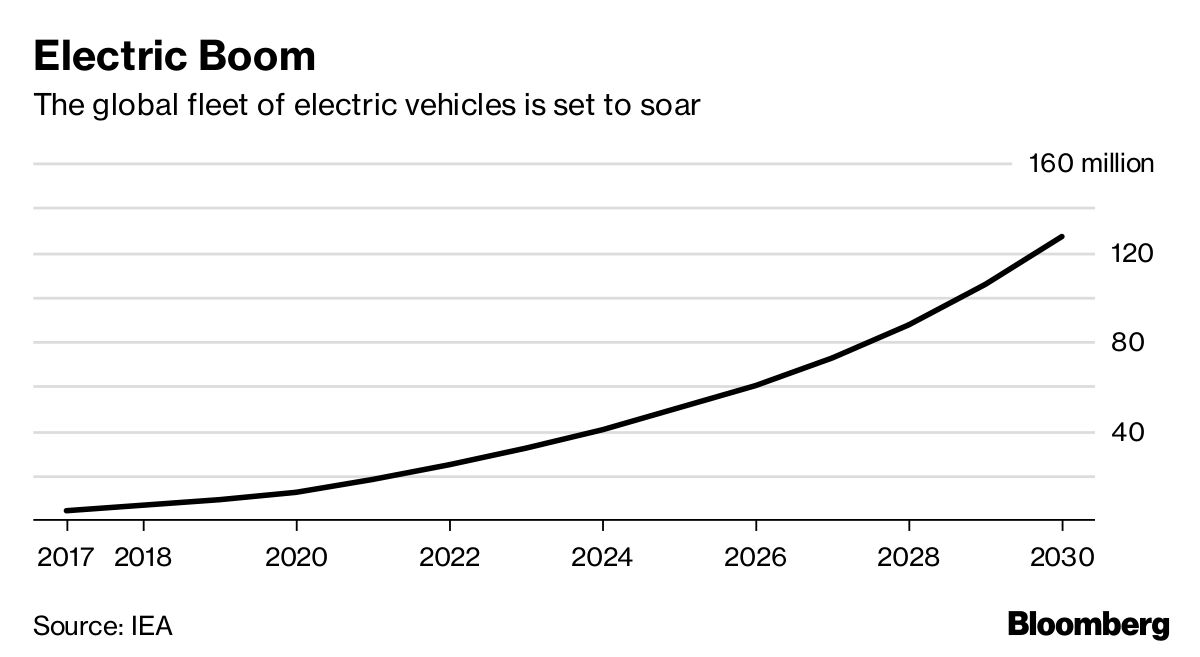

The energy industry is undergoing a fundamental shift to lower-carbon sources, from electricity generation to transportation. The Paris climate deal prompted nearly every country in the world to pledge to run their economies on cleaner energy. The International Energy Agency projects that the global fleet of electric vehicles will triple by 2020, leading to existential questions for companies in the traditional oil and gas business.

Vitol’s fund is the latest foray by a large fossil-fuel company expanding further into clean energy. Oil majors from Royal Dutch Shell Plc to Total SA and BP Plc have bought solar developers and electric vehicle chargers to diversify into areas with higher future growth potential. Shell is also working in offshore wind and is part of a consortium that’s building two projects in the Dutch North Sea.

While relatively small, Vitol’s investment of 200 million euros is symbolically significant for the company, which gets the majority of its profit from handling more than 7 million barrels of crude and petroleum products per day. The closely held trading house, controlled by a group of 350 senior traders and executives, saw net income fall 25 percent to $1.5 billion on revenue of $181 billion in 2017.

The wind industry is also undergoing major changes as government support is rolled back. Developers offered to build the first subsidy-free offshore wind farms in Germany last year, followed by the Netherlands. Vitol sees this as an opportunity.

“We think wind will become more merchant and will require the application of knowledge and capability in electricity markets,” Hale said. “We think we can add value, this may take the form of potential long-term power purchase agreements or revenue-stacking models that are familiar to us in our traditional business, but not familiar in wind today.”

Hale says that could boost returns from offshore wind investments, reversing a decline stemming from maturing technology and institutional investors piling into projects as they search for yield. Vitol has previously used its size and scale as a dominant trader in energy markets to boost returns and optionality from its physical assets which include everything from refineries to pipelines and power plants.

Vitol’s venture with Low Carbon is also investing 250 million pounds ($330 million) in energy storageand distributed power generation projects in the U.K. It hired former Citigroup banker Andrew de Pass in Houston this year as part of plans to increase alternative energy asset investments to complement its oil, coal, power and gas trading operations.

Vitol Chief Executive Officer Russell Hardy said last year that the company expects global demand for road fuels to peak by 2027 or 2028. Hale said the trader expects almost 27 percent of European electricity will be generated from wind and solar by 2025.