Budget 2026 May Introduce Targeted Incentives to Accelerate Carbon Capture and Storage Technologies – EQ

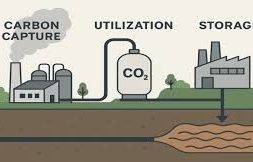

In Short : The Union Budget 2026 is expected to propose incentives for carbon capture, utilisation and storage technologies to support India’s decarbonisation goals. Potential measures could include financial support, policy clarity and pilot project backing, aimed at encouraging industry adoption of CCUS solutions while reducing emissions from hard-to-abate sectors and strengthening the country’s long-term climate strategy.

In Detail : The Union Budget 2026 is expected to place increased emphasis on carbon capture, utilisation and storage technologies as part of India’s broader decarbonisation strategy. Policymakers are exploring targeted incentives to encourage early adoption and deployment across key industrial sectors.

CCUS technologies are gaining importance globally as industries seek ways to reduce emissions where direct electrification or renewable substitution remains challenging. Sectors such as cement, steel, fertilisers and refining are viewed as prime candidates for CCUS integration.

Proposed incentives may include financial support mechanisms, viability gap funding and tax-related benefits to offset the high initial costs associated with CCUS projects. Such measures could improve project feasibility and attract private sector participation.

Budgetary support for pilot and demonstration projects is also being considered to help scale emerging technologies. Successful pilots can provide critical data, build technical confidence and lower perceived risks for investors.

Policy clarity around carbon utilisation pathways and storage frameworks is seen as essential for accelerating adoption. Clear guidelines on storage safety, monitoring and long-term liability can strengthen investor confidence.

The development of CCUS infrastructure could also create new industrial opportunities, including carbon transport networks and utilisation-based products. These developments can contribute to job creation and technological advancement.

Incentivising CCUS aligns with India’s long-term climate commitments while allowing industries to continue operations during the transition to cleaner processes. It offers a pragmatic pathway to manage emissions without disrupting economic growth.

Global collaboration and technology partnerships may play a key role in building domestic CCUS capabilities. International experience can help reduce learning curves and improve project design.

If incorporated into Budget 2026, CCUS incentives would signal a strategic shift toward addressing emissions from hard-to-abate sectors. Such measures could strengthen India’s climate action framework and support a balanced, technology-driven approach to decarbonisation.