Critical materials in India’s quest for self-reliance in solar technologies: Silicon – EQ Mag Pro

India’s desire to obtain self-sufficiency in solar energy needs to be backed with the necessary technology required to achieve it

Material Intensity of Clean Energy

The low-carbon future that India and the rest of the world is moving towards will be far more material intensive. This is because clean energy technologies need more materials to aggregate low-quality (highly dispersed) renewable energy (RE) than technologies that extracted and moved energy dense fossil-fuels. Consequently, raw material (metals and minerals) availability is expected to be one of the biggest challenges in decarbonisation efforts and electrification of the economy.

By one estimate, increase in demand for materials between 2015 and 2060 is projected to be 87,000 percent for electric vehicle batteries, 1,000 percent for wind power, and 3,000 percent for solar cells and photovoltaics (PV). Generating one terawatt of electricity from solar energy could consume 300-400 percent more materials intensive than generating electricity using natural gas or coal as fuel.

Silicon in Solar Cells

The precursor material for both electronic-grade silicon (higher level of purity) and solar-grade silicon (slightly lower grade of purity) is metallurgical-grade silicon. The basic process to convert the feedstock SiO2 (silicon dioxide or silica) or quartz to Si (silicon) involves reduction (decrease in oxidation number, usually by gaining electrons) followed by purification of the resultant zerovalent (inert) solid, and finally recrystallizing it into forms that can be further processed. Carbothermal reduction of SiO2, invented in the nineteenth century is overwhelmingly the dominant process for the first stage in the Si industry today. This reaction is performed with graphitic carbons as the reducing equivalents for converting lumpy quartz to zerovalent Si within electric arc furnaces. The operation of arc furnaces for metallurgical-grade Si requires roughly 12 kWh/kg (kilowatt hour per kilogram) of electricity. Significantly more energy is required for refining this Si into purer forms of crystalline or solar grade Si (polysilicon).

Once solar-grade silicon is produced, the subsequent processing steps involve wafer production, solar cells manufacture and solar module production. A solar PV array consists of one or more electrically connected PV (photovoltaic) modules, each containing many individual solar cells, integrated with balance-of-system (BOS) hardware components, such as combiner boxes, inverters, transformers, racking, wiring, disconnects, and enclosures. A typical Si PV module consists of a glass sheet for mechanical support and protection, laminated encapsulation layers of ethylene vinyl acetate (EVA) for ultraviolet (UV) and moisture protection; 60 to 96 individual solar cells, a fluoropolymer back sheet for further environmental protection; and an aluminium frame for mounting. PV cells are either wafer-based or thin film. Wafer-based cells are fabricated on semiconducting wafers and can be handled without an additional substrate, although modules are typically covered with glass for mechanical stability and protection. The vast majority of commercial PV module production has been and remains silicon-based, for reasons that are both technical and historical.

Resources and Production

Even in a scenario where the world shifts to 100 percent (RE), silicon scarcity is not anticipated. Silica found in nature as sand, usually in the form of quartz is the second most abundant element on earth’s crust after oxygen. However, the collection and manufacture of crystalline Si required for PV cells are extremely challenging. Si in nature is found only as impure, oxidized sand or silicates and the chemistries required for purification, reduction, and crystallization are complex. These processes are industrially complicated, costly, and polluting, manifesting in high energy and environmental costs for crystalline, solar-grade Si PVs.

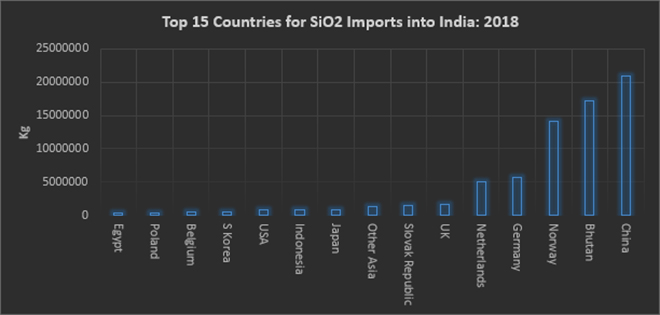

Given the complexity in the manufacture of Si, production capacity of silicon is considered a strategic asset in the solar value chain. This is in contrast to fossil fuel sector where resource endowment rather than production capacity is the most important strategic asset. Quantitative estimates of the raw material are not made as reserves in most producing countries is abundant in relation to production. In 2019, China was the leading producer of silicon metal and ferrosilicon (in terms of silicon content) with a production of 4.5 million tonnes (MT) that accounted for over 64 percent of global production of about 7 MT. Though India is among the top 15 producers, its production of 60,000 T (counting only silicon content on ferrosilicon) was less than 1 percent of global production in 2019. In 2018 Bhutan was the second largest source of India’s SiO2 imports.

![]()

India’s quest for Self-Reliance

The core theme of India’s post pandemic industrial policy is ‘Aatmanirbhar Bharat’ or a self-reliant India. In this context, becoming self-reliant in RE technologies in general and solar technologies, in particular, is an important policy goal. Currently more than 80 percent of solar panels and modules are imported, primarily from China. Cheap imported panels have contributed to India having one of the lowest solar power tariffs in the world but also raised energy security and geo-political concerns. Though India has a solar PV cell manufacturing capacity of 3 GW (gigawatt) per year and solar PV module manufacturing capacity of 10 GW per year, India has no manufacturing units for polysilicon, wafer or ingots. To decrease imports and promote local manufacturing of solar panels, the government has offered a number of incentives.

In 2018, a 20-percent subsidy for capital expenditure in special economic zones (SEZs) was offered to potential manufacturers. In 2021 public procurement of solar components was mandated to be only from class I suppliers that have local content equal or more than 50 percent. Solar PV cells and modules must be sourced from domestic manufacturers for central government schemes to promote the use of solar energy such as PM KUSUM (Pradhan Mantri Kisan Urja Suraksha Evem Utthan) for replacing electrical agricultural pumps with solar pumps and for subsidised rooftop solar projects. In addition, the government has also imposed basic customs duty (BCD) on import of solar PV cells and modules effective from April 2022. In 2021, the Indian Renewable Energy Development Agency (IREDA) released a list of 18 bidders for its production linked incentive (PLI) scheme for setting up fully integrated production of Si solar cells. Four applicants have proposed a 4 GW solar factory each that is fully integrated from polysilicon (highly pure form of crystalline silicon) production through wafer, solar cell and module manufacturing. The PLI scheme is expected to attract a direct investment of around US$2.33 billion. Given the strong response for the PLI scheme for manufacturing solar modules, the scheme outlay has been further increased to US$3.2 billion from US$600 million earlier. This is expected to increase setting up of cell and module manufacturing capacity from 10 GW to 40 GW.

This is not the first time India is trying to establish polysilicon manufacturing capabilities for the semiconductor and solar industries. In 2008 some of the major players announced plans to manufacture polysilicon. The plans did not materialise despite the government’s offer of land and other incentives as the cost of electricity proved to be too high and the quality of supply too low. This time may be different not only because the quality of electricity supply has improved but also the market size for solar panels has increased tenfold. However, self-reliance in the production of wafers, cells and modules may not extend right up to the upstream end of the solar value chain. In 2018, India imported over 72 million tons of SiO2 and over 28 percent was from China. Though sources of SiO2 imports were highly diversified it would not count as secure or self-reliance.

The high cost of production of silicon metal is expected to limit entry of new players. The production of silicon metal using arc furnaces is energy intensive, which increases its cost of production. Industrial electricity is not necessarily cheap in India and this matters as a large portion of the total production cost is related to its energy consumption. Further, the cost of producing silicon metal is controlled by the prices of other components such as coal, quartz, oil, natural gas, and electrodes. Quartz mining is concentrated among few players which means India is not likely to be a member of the silicon producing and exporting countries. To ensure overall mineral security and to acquire equity assets, India has plans to set up a joint venture company namely Khanij Bidesh India Ltd. (KABIL) with the participation of three central public sector enterprises namely, National Aluminium Company Ltd. (NALCO), Hindustan Copper Ltd.(HCL) and Mineral Exploration Company Ltd. (MECL). KABIL is expected to carry out identification, acquisition, exploration, development, mining, and processing of strategic minerals overseas for commercial use and meeting country’s requirement of these minerals. India’s experience in acquiring oil and gas equity assets for energy security had only modest success but that experience may enrich India’s quest for mineral security.

Source : orfonline