Suzlon Energy must repay $172 million outstanding on such securities that were issued as part of a debt restructuring

Investors in Indian corporate debt are watching whether a stressed wind-turbine maker will repay its dollar-denominated convertible bonds due Tuesday, and help avoid further widening of strains in the nation’s credit market.

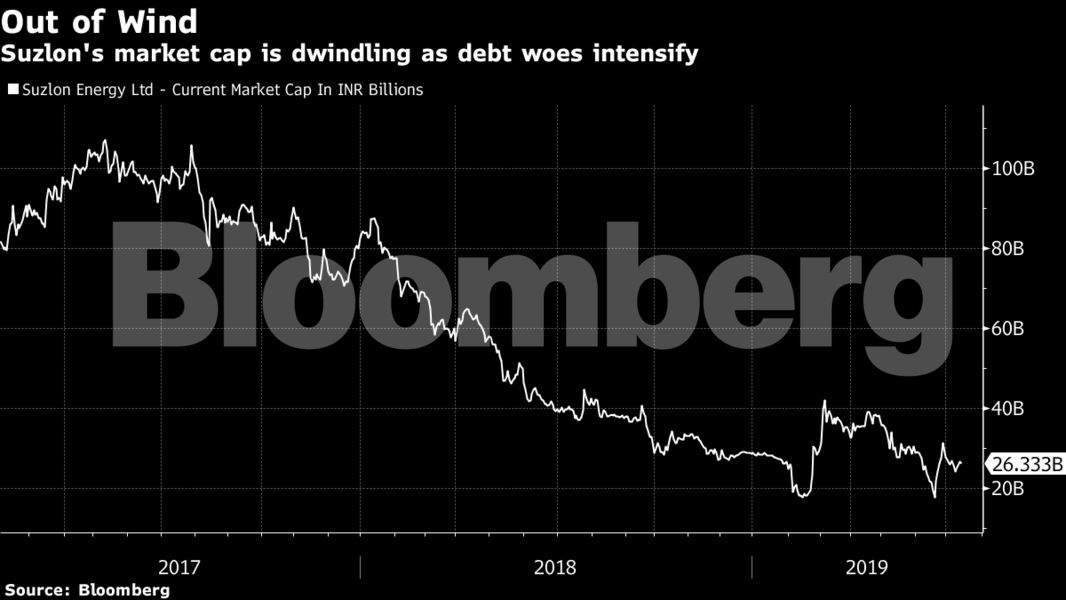

Suzlon Energy, which became India’s biggest convertible note defaulter when it missed payments in 2012, must repay $172 million outstanding on such securities that were issued as part of a debt restructuring. While that revamp helped the company’s shares surge in 2014-2015, they’ve since slumped after India’s shift to auctions for building wind projects increased competition and diluted Suzlon’s market share.

The company’s bank facility ratings were cut to default by Care Ratings in April after it failed to meet payback obligations to its lenders. Any delay in repayments on the convertibles could further spook credit investors already reeling under a spate of defaults in the last year, from IL&FS Group to Dewan Housing Finance.

Some traders in Suzlon’s bonds are pinning their hopes on a proposed acquisition of the embattled company by Toronto-based Brookfield Asset Management Inc. A person familiar with the matter said earlier in July that Brookfield may make a binding offer for a stake in the company as soon as the end of the month.

“Suzlon’s bondholders don’t have many choices now,’’ according to Raj Kothari, London-based head of trading at Jay Capital. “The redemption will depend on the progress of the Brookfield deal.’’

A spokeswoman at Suzlon, which is based in Pune in the Maharashtra state, declined to comment.

Shares of the company were at 4.86 rupees at 12:45 p.m. in Mumbai, close to the lowest since its 2005 listing on the exchange.