Texas dealt a potential death blow to what would be the largest-ever U.S. wind farm: American Electric Power Co.’s $4.5 billion Wind Catcher project.

The Texas Public Utility Commission on Thursday unanimously rejected the project as proposed, saying it doesn’t offer enough benefits for ratepayers as currently structured. American Electric said it was evaluating its options.

“Looks like curtains to me,” said Paul Patterson, an analyst at Glenrock Associates LLC. “Almost everyone was opposed to this. Barring any big concessions from AEP, it looks to me like it’s dead.”

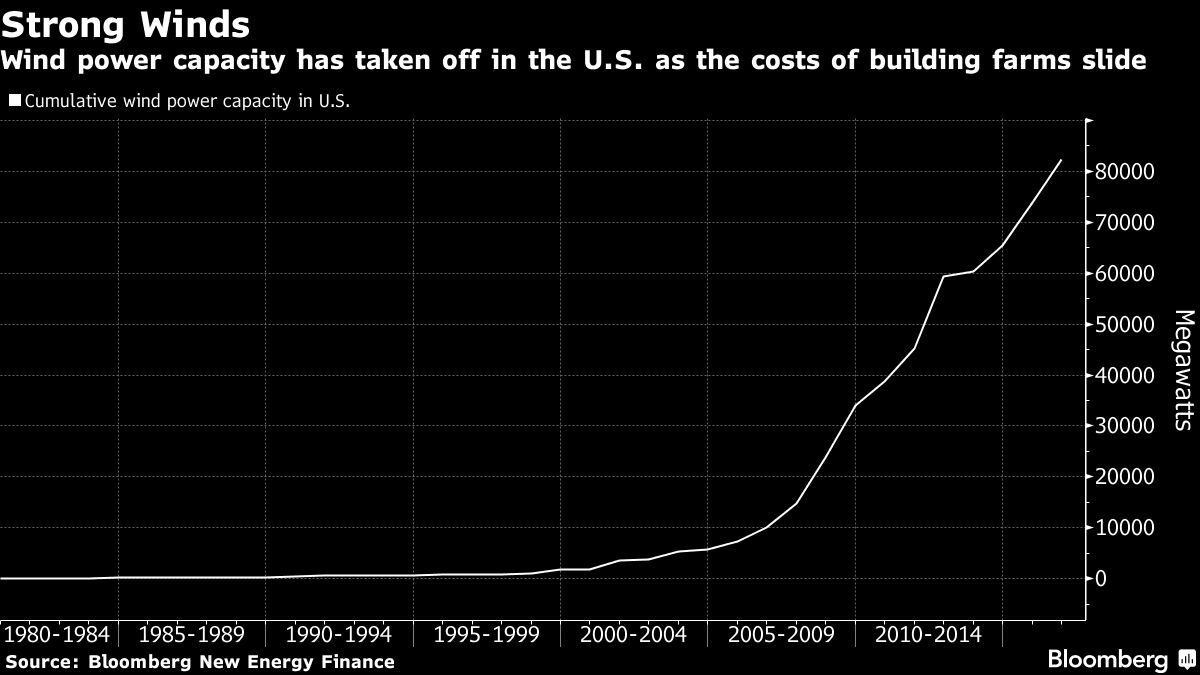

The denial could spell the end of American Electric’s ambition to make one of the largest renewable energy purchases ever by a U.S. utility company. The rejection comes as utility owners including Xcel Energy Inc. and Warren Buffett’s Berkshire Hathaway Inc. have been seeking state approvals to charge customers for renewable energy projects that have become more competitive with electricity produced by fossil-fuels.

“We’re extremely disappointed in today’s Public Utility Commission of Texas decision rejecting our Wind Catcher proposal,” Melissa McHenry, an American Electric spokeswoman, said in an email.

Oklahoma Project

The project that Invenergy LLC is developing in Oklahoma needs approvals from both Texas and Oklahoma to move forward, American Electric’s Chief Executive Officer Nick Akins said Wednesday during an earnings call with analysts. Oklahoma’s attorney general and a state administrative law judge concluded in February the company failed to prove there was an economic need for the project and that it left customers shouldering too much of the risk.

Changing the size of the project “would be suboptimal,” Akins said. “So we’re really focused on making sure that all of the jurisdictions approve it.”

He added that Wind Catcher is not needed for American Electric to meet its growth targets.

Shares rose 1.8 percent to $70.65 at 2:59 p.m. on the New York Stock Exchange.

American Electric’s Southwestern Electric Power has proposed owning 70 percent of the 2-gigawatt project. Arkansas and Louisiana already approved the plans. Oklahoma has yet to issue a final decision. The project includes a transmission line to take the power to Tulsa and into Texas, Arkansas and Louisiana.

American Electric’s proposal tapped a financial model that utilities have long used to build nuclear, coal- and natural gas-fired plants: by tacking costs — plus a profit — onto customers’ bills. The company asked regulators in four states for permission to use the strategy for a sprawling project almost twice the size of Singapore.

“The costs are known,” DeAnn Walker, chairman of the Texas commission, said Thursday at a hearing. “But the benefits are based on a lot of assumptions that are questionable.”