Scatec Solar ASA Is Bringing Solar Energy To The World

Scatec Solar ASA : is a Norweigan independent renewable power producer with operations focused on emerging market countries like Egypt, Malaysia, and Mozambique. The company builds, owns, and operates solar power plants currently generating around 1.55 GW in electricity across 14 countries in four continents.

Scatec differs from other listed renewable energy companies like Brookfield Renewable Partners (NYSE:BEP) and Clearway Energy (NYSE:CWEN) in that its focus is almost exclusively on less economically developed but emerging market countries. These markets pose heightened risk around foreign exchange movements, high inflation, and political stability. Mali, where Scatec has a 33 MW project in the backlog had a military coup this year, 8 years after the last one.

However, they also hold immense potential for growth and stand to benefit from the same long-term tailwinds driving renewable energy capacity expansion in developed countries. Fundamentally, places like Rwanda, Mozambique, Honduras, Czech Republic, and Malaysia still need to radically reduce their carbon emissions to meet ambitious decarbonisation targets especially as all have ratified the Paris climate agreement.

Hence, Scatec’s investment proposition is one of a modern renewable company investing in significant solar power production expansion in fringe markets overlooked by traditional green investing. In a sense, the company is getting in early of what will be an inevitable larger structural shift by these economies towards renewable energy. The benefits are not just limited to decarbonising respective electricity grids but reducing dependency on fossil fuels. Further, and for some of these countries which still suffer from power outages, solar power will help meet the gap between current electricity generation and demand from their rapidly growing middle-class population.

The market has bought heavily into this narrative with Scatec’s stock price, trading on the Oslo Stock Exchange, up by 180% over the last year. The stock also trades on the significantly less liquid over-the-counter market in the USA.

Company Structure And 2020 Third-Quarter Financials

Scatec’s internal structure is divided into four segments.

1. Development & Construction: Scatec sells development rights and delivers construction services to power plant companies where it has economic interests.

2. Power Production: Electricity is produced for sale under long term power purchase agreements with state-owned utilities or corporate off-takers or under government-based feed-in tariff schemes.

3. Services: Operations & maintenance and asset management services provided to solar power plants where Scatec Solar has economic interests.

4. Corporate: Consists of activities of corporate services, management and group finance.

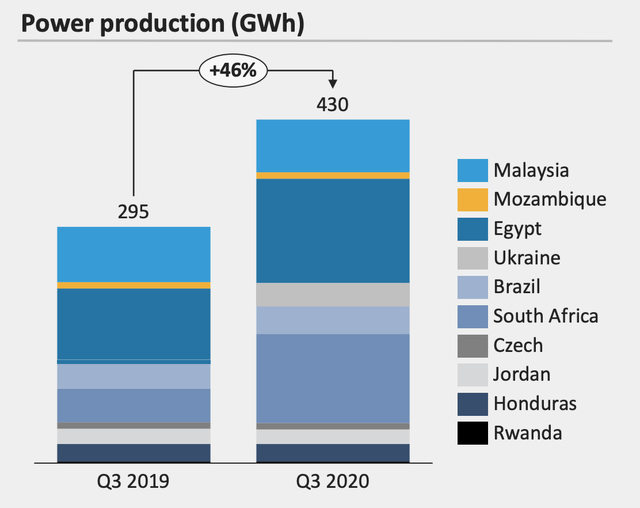

Scatec last released financials for its 2020 third-quarter which saw a 46% year-over-year increase power production to 430 GWh.

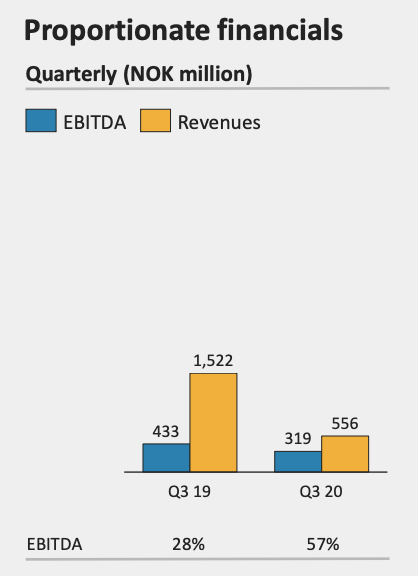

However, revenue and EBITDA were both down by 63% and 26% respectively. This was due to lower construction activity.

Such a sharp decline in revenue is worrying but should be expected due to the nature of the Scatec’s business. Compared to other solar energy companies who mainly realize revenue from power production, Scatec revenue is lumpier due to its dependence on Development & Construction for a significant proportion of revenue. This was the case in Q3 2019 where revenue from this segment accounted for 74% of total revenue. Power Production, which grew 33% year-over-year, now accounts for 82% of total revenue and generated positive EBITDA margins of 82% compared to a loss for Development & Construction.

The company has also expanded beyond just solar power with its $1.17 billion acquisition of SN Power, a leading hydropower developer and independent power producer focused on Africa, Asia and Latin America. SN Power, previously owned by Norwegian private equity outfit Norfund, will expand Scatec’s portfolio beyond solar to hydro, wind, and storage. The combined entity will have 3.3 GW in operation or under construction and targets 4.1 terawatt-hours in production by 2021

SN Power had proportionate revenues in 2019 of NOK 1.80 million ($217,000) and EBITDA of NOK 1.15 million ($132,000). The combined company would have realized revenue of NOK 8.11 million ($930,000) and EBITDA of NOK 2.72 million ($312,000), corresponding to an EBITDA margin of 34%.

Harnessing The Sun

Scatec’s focus on emerging market countries helps the company differentiate itself in a sea of ESG complying renewable energy companies. This has helped the company pull investors attracted by the inherent thrill and intrigue of the emerging market. Fundamentally, climate change and environmental degradation is a problem that knows no borders and will affect us all. Poorer countries cannot let themselves be left behind in the effort to decarbonise our planet.

Indeed, global efforts to address climate change will fail if any progress in developed economies is entirely offset by non-renewable energy supply growth in emerging countries. This is especially true as electricity demand grows in line with rising incomes and standards of living. This means Scatec helps accomplish a critical need in this generational push for renewable energy. And while the risks are heightened with emerging markets, the need for these countries to fully partake in the renewable energy revolution presents a long-term tailwind that will almost undoubtedly playout in the post-pandemic world.