Record Month Shoots Green Bonds Past Trillion-Dollar Mark

Amid global turmoil, green bond issuance is serving as a beacon for sustainability, surpassing $1 trillion issued since the market’s inception in 2007

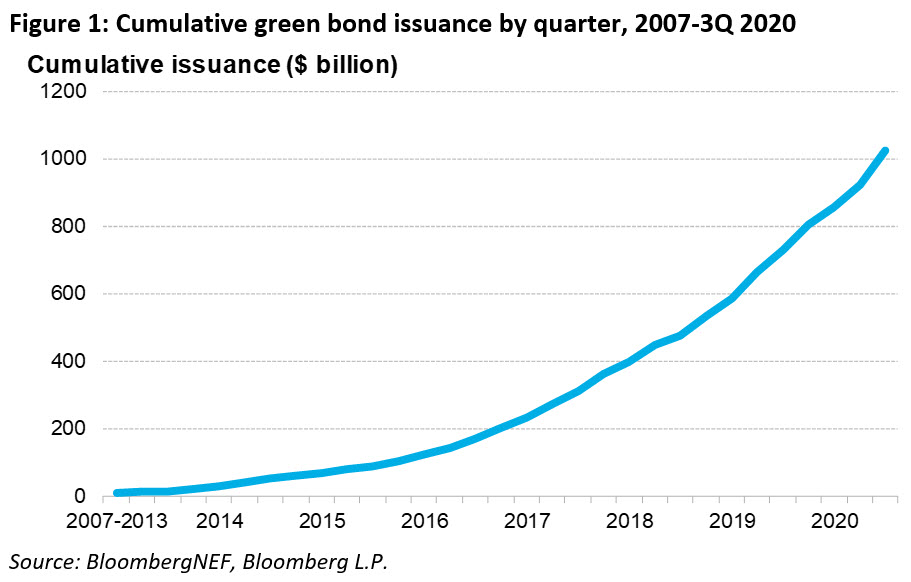

London and New York: Green bonds have passed their biggest milestone yet, with more than $1 trillion issued since these securities first emerged in 2007, according to research company BloombergNEF (BNEF). They are the longest standing and most heavily used instrument in the sustainable debt market, which covers a range of fixed-income products offering environmental and social benefits.

More than $200 billion worth of green bonds – which are used to finance the pursuit of environmental projects and activities, from wind farms to wastewater management – have been issued in 2020 thus far. This represents a 12% increase compared with the first nine months of 2019. Together, corporate, government, municipal and mortgage green bond issuance in 2020 trailed 2019’s volumes through August. This all changed in September, when green bonds saw more than $50 billion brought to market in that month alone.

Green bonds have become known for their impressive growth, with global issuance increasing every year to date, reaching a record of more than $270 billion last year. At times during 2020, as the coronavirus crisis took hold and economies across the world wilted, it looked as if this trend might be interrupted.

“For much of this year, green bond issuance has lagged behind 2019. But the bumper month in September, with more than $50 billion issued, offers hope of a possible boom in the last quarter of the year,” said Mallory Rutigliano, a sustainable finance analyst at BNEF.

One of the biggest boosters this September came from Germany. The federal government issued a 6.5 billion-euro ($7.7 billion) sovereign bond at the start of the month, making it this year’s biggest single new green bond. Similarly, the Swedish government and Électricité de France (EDF) helped jumpstart the month, with more than $5 billion combined.

In reaching their cumulative $1 trillion issuance milestone (see chart below), green bonds have also pushed the wider sustainable debt market – which includes social bonds, sustainability-linked loans, green loans and others – over the $2 trillion mark.

Green bonds were the first sustainable debt instrument to catch investor attention a decade or more ago, but some of the others have been growing rapidly of late. In the first nine months of 2020, green bonds accounted for 47% of the sustainable debt issued worldwide.

Maia Godemer, a BNEF sustainable finance associate, commented: “The integration of environmental, social and governance criteria has never been more important for investors than in 2020. We’ve seen this reflected in the debt market, and it is not only likely that these varieties of financing will grow in volumes in coming years, but we will see further innovation. One driver is likely to be increasing pressure to standardize rules around green bonds, particularly in Europe.”

The BloombergNEF sustainable debt universe consists of green bonds, green loans, social bonds, and sustainability bonds that follow the use-of-proceeds requirements set by the International Capital Market Association (ICMA) and Loan Market Association (LMA), as well as all sustainability-linked bonds and loans that follow the guidelines set by the ICMA and the LMA. BNEF also breaks out a subset of this universe into core “principles-aligned” bonds and loans that follow all ICMA and LMA recommendations, such as specific reporting or project selection criteria.