How BP Plans to Make Oil-Like Returns From Renewables

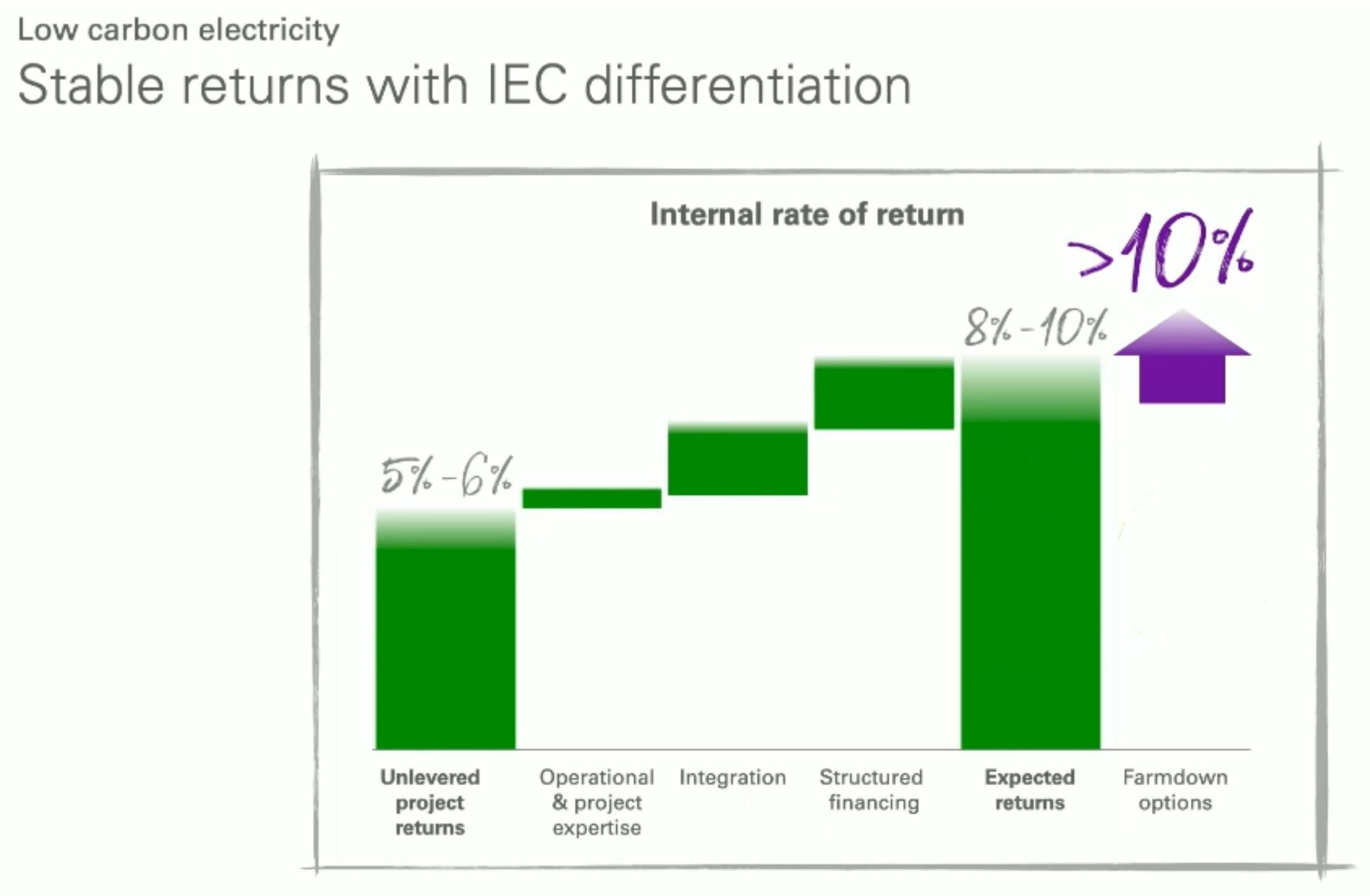

The oil major wants to make returns of 8 to 10 percent from renewables projects as it chases a 50-gigawatt target for 2030.

The shift to low-carbon energy will transform oil companies, and BP wants to be at the vanguard of the industry in making those changes, having set a net-zero target for 2050 earlier this year. But there’s one thing BP doesn’t want to change: the returns it offers its investors.

In a three-day event for investors this week, BP provided more detail on how it hopes to build 50 gigawatts of renewable power capacity while pocketing the kind of returns it’s used to.

As it rethinks its strategy under new CEO Bernard Looney, BP has temporarily halved its dividend. But that “reset” isn’t meant to be forever.

BP is targeting returns of 8 to 10 percent from its low-carbon power business. That compares to an average margin for oil and gas exploration of 8.5 percent, according to NYU’s Stern School of Business.

“Can we deliver the 8 to 10 percent returns from renewables? The answer is very simply: yes,” Looney said this week. “We actually believe we can do better; these returns could turn out to be conservative.”

BP’s plan to supersize its returns from renewable projects. (Credit: BP)

“We know returns start at around 5 to 6 percent on an equity basis in a competitive auction,” said Looney, adding that there are four factors that could help BP make up the shortfall from there. Those factors are BP’s projects and operations experience, its power trading capabilities, its ability to eke out better operational efficiency, and its financing capabilities.

Looney said BP’s trading capabilities alone could lift returns by 1 to 2 percent.

Central to BP’s approach will be offering “firm” power-purchase agreements backed by the company’s natural gas as well as renewables, with merchant risk thrown in to boost returns.

“We see value in the merchant exposure,” said Dev Sanyal, the company’s EVP of gas and low-carbon energy, during the BP event on Tuesday. “Through our trading business, we have the ability to market the uncontracted merchant exposure or become the power offtaker. We have the expertise, track record and capacity to manage and optimize volatility and risk.”

Competition for projects and squeezed PPA prices make the market a highly competitive one, says Tom Heggarty, principal analyst at Wood Mackenzie’s energy transition practice.

“BP and their peers will have to adapt to this reality, but their trading capabilities, balance sheet strength and long-term ambitions in this space should leave them as well placed as anybody,” Heggarty told Greentech Media.

Getting the gigawatts in the first place

BP’s new mantra — or one of them, anyway — is “value over volume.” That approach is evident across the company’s fossil-fuel portfolio, which is being cut by 40 percent, and will also apply to its renewables endeavors.

That said, BP needs to invest now to build its clean power business and reach the scale it is targeting. The target of 50 GW of renewables by 2030 (which incidentally is the same as French utility giant EDF’s target) includes an interim 20 GW goal for 2025. Sanyal said the targets reflect the volume BP wants to bring to financial close; the company may decide not to own all of that capacity.

BP’s existing renewables pipeline stands at 20 GW, dominated by solar developer Lightsource BP’s contribution. London-based Lightsource BP’s development pipeline now stretches to 16.1 GW, up tenfold from when BP first took a stake in the business in 2017.

“Lightsource BP clearly has a large and geographically diversified portfolio of solar PV assets, but it’s worth taking these numbers with a pinch of salt,” said Heggarty.

“Those are likely to be at varying stages of development. Some may have grid connection and PPAs (auctioned or otherwise) secured, others may be much earlier-stage with a greater chance of being abandoned.”

Heggarty added that competition is strengthening in large-scale renewable markets, meaning that “they’ll also — potentially — need to be willing to accept lower returns to win competitive auctions.”

Sanyal said Lightsource BP would continue looking to acquire portfolios of “very early-stage” solar projects where it can add additional value.

Options away from solar

Solar may dominate BP’s plans for renewables today, but it’s not the only show in town. BP’s recent strategic partnership with Equinor in the U.S. offshore wind market gives it a stake in another 4.4 GW portfolio, and Sanyal confirmed that BP wants to expand into other offshore wind markets, although he did not provide further details.

BP’s onshore wind capacity in the U.S. stands at 1.7 GW, and the company gets a smaller contribution from its BP Bunge biofuel business in Brazil — “the Saudi Arabia of biofuel,” as BP’s chief economist Spencer Dale called it.

In addition to its firmer 20 GW portfolio of completed or development projects, Sanyal said the company has options on 21 GW of “early-stage” opportunities. These include building on its onshore wind business in the U.S.

As the company chases its 50 GW target, it’s reasonable to expect BP will make more project acquisitions across all technologies.