How India is set to become a leader in Pumped Hydro Storage

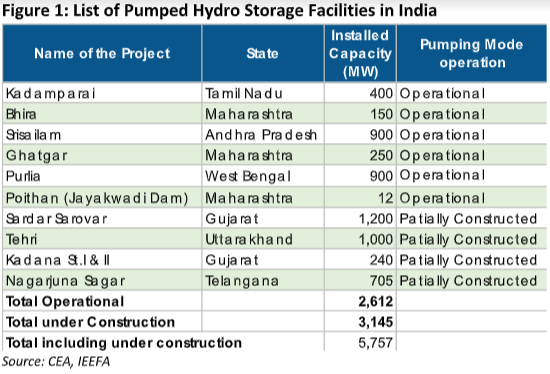

Plans have been formulated for India to become a world leader in PHS. Some 2.6 GW of PHS are already operational with another 3.1 GW under construction. Proposals for another 8.9 GW are on the drawing board.

US$10-20 bn annually must continue to be invested in expanding the national grid transmission and distribution system. Flexible on-demand peaking capacity of all types also needs to be added to balance low cost but highly variable renewable energy generation.Storage is another key issue and IEEFA expects pumped hydro storage (PHS) to play a central role. PHS works by storing energy in water in an upper reservoir, pumped from a second reservoir at a lower elevation when there is excess power in the system. When there is demand for energy, the water in the upper reservoir is released and as it falls, it turns turbines that create the power.

This article evaluates the progress and potential of PHS as a key sector in India, ideally requiring at least US$20 bn of new investment in the coming decade.

Plans have been formulated for India to become a world leader in PHS. Some 2.6 GW of PHS are already operational with another 3.1 GW under construction, albeit much delayed. Proposals for another 8.9 GW are on the drawing board. However, given the enormous social costs and absence of a strong price and policy signal for producers and consumers, progress has been stalled for many years.

There are a number of reasons for the delay in PHS projects. Large hydro powerprojects in India commonly get embroiled in social and political issues mostly related to loss of significant areas of agricultural flood plains and forest lands, and forced relocation without just compensation for affected rural communities. Interstate disputes over water rights compound environmental issues such as flood safety concerns and agricultural needs.

Further, with seasonal water flows and mountainous, remote locations, hydro-electricity requires very patient capital, and engineering technology is certainly challenged. India’s enormous plans for new low-cost, deflationary, domestic renewable energy also comes with an associated, critical need to accelerate the deployment of storage.

Recent developments look promising

India recently amended its ‘hybrid wind-solar with storage’ policy to clarify that any form of storage – not just batteries – could be used in hybrid projects, including PHS, compressed air and flywheels.

Then, in March 2019 India’s Ministry of Power proposed electricity rule changes to incentivise electricity supply at times of peak demand, a key pricing signal needed to underpin financial bankability of storage projects.

Both government initiatives look very promising.

PHS has traditionally been built in mountainous regions using existing modified upper and lower lakes for reservoirs. IEEFA notes large scale PHS can also be

undertaken on a small site using a closed or open water loop, a distinct advantage relative to more complex hydro-electricity dam complexes.

Refurbishing end-of-life dams and adding PHS to existing water storage dams could also inject significant value-add to India’s existing portfolio of 45GW of hydro-

electricity capacity.

In July 2017 the Central Electricity Authority (CEA) released a report focusing on the need to operationalise existing PHS plants built but yet to be commissioned, as

well as prospective projects. The CEA estimated there are 96GW of PHS capacity at 63 sites across India.

The CEA concluded that a peaking power tariff is required to incentivise PHS in India. Additionally, there is significant capacity that could be added by modernising

and retrofitting existing hydro-electricity capacity with PHS capacity.

India has witnessed several PHS proposals:

In 1970 India’s first PHS project commenced at Nagarjuna Sagar in Telangana with an installed capacity of 705 megawatts (MW). The hydro-electricity capacity was commissioned during 1980-85. In 2017 the CEA reported that “the project is not working in pumping mode as the tail pool dam construction took a long time and is still not functional.”

The 1,450 MW Sardar Sarovar dam project in Gujarat has been massively delayed since 1961 due to technical feasibility issues as well as the enormous negative social impact due to submerging 40,000 hectares of land. In September 2017 it was finally reported as having been commissioned as a dam providing flood management, irrigation, drinking water and hydro-electricity capacity, at a financial cost of Rs 16,000 crore (US$2.3bn). In 2017 the CEA reported that the final component to convert the dam into a 1,200MW PHS was under construction and due for completion in October 2018, but no confirmation has been reported since.

In June 2017 Karnataka Power Corporation Limited announced the 2 GW Sharavathy Pumped Storage Project (8 x 250MW) in the Shivamogga and Uttara Kannada districts in Karnataka, using the existing Talakalale and Gerusoppa reservoirs. The 2017 construction cost was estimated at a very low Rs 2.5 crores per MW or a total of Rs 4,862 crores (US$700m) given the limited civil works required, with an estimated construction time of five years.

In February 2018 the Tamil Nadu Generation and Distribution Corporation (TANGEDCO) confirmed plans for a 500 MW Kundah PHS proposal at a total cost of Rs 1,831 crores (US$265m) for commissioning in 2022/23. The project finance is being sourced from the Rural Electrification Corporation (REC). Kundah’s merits include a low capital cost given it leverages two existing reservoirs: the ‘upper’ Porthimund and the ‘lower’ Avalanche-Emerald. Kundah is also in an area least prone to landslides and seismic activity, a key risk in other areas of India.

In October 2018 Odisha Hydro Power Corp (OHPC) proposed a PHS unit totalling 600 MW at its existing 600 MW hydropower plant at the Indravati multi-purpose reservoir in Odisha. The International Finance Corporation (IFC) is planning a $210 million tender for construction of the project with total investment estimated at Rs 3,000 crore (US$430m).

Another 1GW (4 x 250MW turbines) of PHS is proposed on Turga dam in West Bengal. In November 2018 the Japan International Corporation Agency (JICA) announced financing of US$260m for the project, which is not scheduled for completion until 2027.

The emergence of PHS as a key facilitator of variable renewable energy is critical for India. International market developments mirror this thinking.

Case studies from Australia

In Australia, low cost renewable energy projects delivering tariffs of US$25-35/MWh are now booming. In belated support of this, new PHS investment proposals worth US$6-7bn across nine projects and covering 3.05GW with a collective 358GWh of storage capacity, are under active discussion.

While the Snowy 2.0 US$5bn 2GW/350GWh PHS and associated grid expansion has been garnering the most media attention, there are many other proposals providing

significant geographic diversification.

Conclusion

While hydro-electricity is fraught with social issues in India and many other non-temperate, monsoonal climates and areas of high population densities, PHS has a

much smaller footprint.

PHS can play an immensely important role in facilitating India’s improved energy security and transition to a lower cost, low carbon electricity market that will

require flexible, dispatchable, as well as peak power capacity, especially until battery storage becomes cost competitive.

[Kashish Shah, a Research Associate at IEEFA India co-authored this piece.]

DISCLAIMER: The views expressed are solely of the author and ETEnergyworld.com does not necessarily subscribe to it. ETEnergyworld.com shall not be responsible for any damage caused to any person/organisation directly or indirectly.