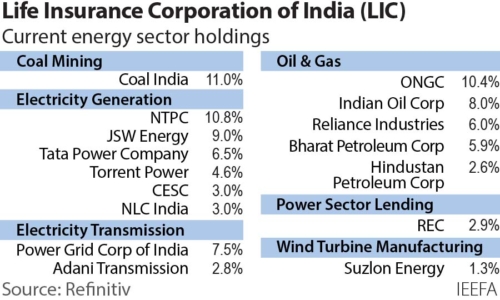

Exposure to oil and gas and thermal power companies could tarnish LIC’s ESG profile

The country’s largest institutional investor, Life Insurance Corporation of India (LIC), is slated to hit the capital markets with an initial public offering (IPO) as early as the end of the current fiscal year, in line with the Government of India’s divestment plans.

With nearly US$500bn in assets and a valuation estimated up to US$203bn, the IPO is touted to be India’s largest till date and is bound to elicit interest from all quarters, domestically and globally.

The government wants an active participation from foreign institutional investors too and is mulling changes in the foreign direct investment (FDI) policy. Equity investment by foreign investors is allowed for most Indian insurers, but not in LIC, which is a special entity created by an Act of Parliament.

In parallel, the finance ministry is reportedly also working to complete an environment, social and governance (ESG) rating for the insurance behemoth before its mega IPO hits the market, to tap into the large and growing global pool of ESG-aligned assets.

Investors are aligning with ESG

The number of investors aligning their practices with ESG has exploded in the past two years.

Bloomberg expects ESG assets to hit US$53 trillion by 2025, a third of global assets under management. Further, the United Nations-supported Principles for Responsible Investment (PRI), the world’s leading proponent of responsible investment, has more than 3,500 signatories, among them the world’s biggest institutional investors representing US$121tn in assets under management. These signatories commit to integrating ESG factors into investment decision making.

Most of the largest companies in the world are already reporting their ESG profile in line with globally recognised frameworks or standards.

Indian companies are lagging

Indian companies have been slow to catch up, lacking both regulation and a push from domestic institutional investors. The regulatory environment is transforming as the new business responsibility and sustainability reporting (BRSR) standards become mandatory for Indian companies, requiring listed companies to disclose their ESG footprint.

With LIC going for an ESG rating, it is clear the government wants the country’s biggest asset manager to be better placed to anticipate future risks and opportunities in its operations and investment practices…Read More…