Progress as the world has designed and defined it requires material production which, in turn, requires energy. Historically, therefore, fossil fuels like coal were key in economic growth across geographies.

Today the developed economies stand on the edifice of fossil fuels, carbon-intensive industries and lifestyles that have resulted in global warming. The same growth path is now being questioned, and the poor and developing countries are being asked to build, find and fund newer low- and no-carbon models to lift their people out of poverty and achieve their development goals.

Consequently, there are growing calls for India to declare a net-zero year: to offset its carbon emissions by various processes of GHG absorption and removal. India is aware that such calls are irrational, and despite international pressure, has avoided making pledges or setting hard targets, beyond its commitments at the Paris climate conference in 2015. Indeed, “net zero” is not possible with India’s current levels of reliance on coal. Its shift away from this fuel will depend largely on the quantum of additional money and resources that can be invested into alternative energy. However, as global climate finance has both under-performed and been subject to clever redesignation, countries such as India remain in dire need of green financing.

In August 2020, UN Secretary-General António Guterres urged India to give up coal immediately. He asked that the country refrain from making any new thermal power investments after 2020, and criticised its decision to hold auctions for 41 coal blocks earlier that year. Similarly, in March this year, in a message to the Powering Past Coal Alliance Summit, the Secretary-General urged all governments to “end the deadly addiction to coal” by cancelling all global coal projects in the pipeline.[1] Pre-pandemic, India had the second largest pipeline of new coal projects in the world. He also called the phasing out of coal from the electricity sector “the single most important step to get in line with the 1.5-degree goal of the Paris Agreement.”[2]

For much of human history, photosynthesis was the primary source of mechanical energy.[3] Human and animal muscles powered by food and fodder, made the world go around. Photosynthesis was also at the root of heat energy derived from burning wood. Eventually, coal replaced wood as the dominant source of heat energy, but still represented the energy of photosynthesis stockpiled over hundreds of years. The advent of the steam engine in the 17th century helped humans change the heat energy released from coal, to mechanical energy.

This development also upended the paradigm of material production. According to a recent estimate, coal was accounting for well over 90 percent of energy consumption in England by the mid-19th century, owing in large part to the steam engine.[4] For long, researchers had been divided over the question of whether coal was pivotal to the industrial revolution. Scholars such as Wrigley (2010) regarded the switch to coal as a “necessary condition for the industrial revolution,” while others like Mokyr (2009) held that the “Industrial Revolution did not absolutely ‘need’ steam…nor was steam power absolutely dependent on coal.”

A November 2020 paper by Fernihough and O’Rourke might just have settled the question: Using a database of European cities spanning the centuries from 1300 to 1900, the authors found that those located closer to coal fields were more likely to grow faster.[5] Those cities, the researchers wrote, “located 49 km from the nearest coalfield grew 21.1 percent faster after 1750 than cities located 85 km further away.”

It is no wonder then, that in March this year, International Energy Agency (IEA) chief Fatih Birol said it will not be fair to ask developing nations like India to stop using coal without giving international financial assistance to address the economic challenges that will result from such a move.[6] He noted that “many countries, so-called advanced economies, came to this industrialised levels and income levels by using a lot of coal,” and named the United States, Europe, and Japan.

This article explores this line of enquiry by examining the consumption of coal across developed and developing countries, and mapping it against key metrics of energy transition. It finds that countries such as India—with their high dependence on coal and a simultaneous growth spurt in renewables—can be the most effective location for climate finance. This is plausible given that per capita coal consumption in India is still far below that of the developed world, and economic transitions are both inevitable and required to be ‘green’.

To be sure, India is struggling with a coal shortage, which has the potential to derail its post-Covid-19 recovery; the same is true for China.[7] Consequently, there is growing scepticism in developed countries, that both India and China will double down on coal and increase production to overcome supply challenges in the future. While such concerns are not unwarranted, they are not unique to the developing world.

Germany, for instance, in the first six months of 2021 ramped up its coal-based generation, which contributed 27 percent of the country’s electricity demand.[8] Three factors contributed to this rise: increase in energy demand amidst the successive waves of the Covid-19 pandemic, increased prices of natural gas, and reduction in electricity generation from renewable energy (particularly wind.) Coal is often the bedrock of energy generation, and its use is impacted by complex market processes that cannot be reduced to normative choices.

Energy Use and Coal

Countries of the Organisation for Economic Cooperation and Development (OECD) are using progressively less energy to power their societies. Multiple factors can contribute to this trend, at least in theory. First is the technical improvements in energy efficiency – i.e., the use of less energy to perform the same tasks. Second is the “activity effect”, or the changes in energy use because of changes in economic activity. This would also encompass a “structure effect” which relates to changes in the mix of human activities that are prompted by changes in sectoral activity, such as transportation. And finally, there could be weather-related changes in energy use – for instance, more temperate weather can reduce the need for heating or cooling.

The IEA quantifies these effects, and consistently finds that the reduction in energy consumption in the OECD countries is largely a result of technical improvements in energy efficiency. This means that the reduced use of energy in advanced countries is not on account of any significant changes in consumer behaviour—otherwise, the activity effect would be the primary determinant of the fall in energy use. While energy efficiency improvements have driven this fall, the IEA finds that the current rate of improvement is not enough to achieve global climate and sustainability goals. Consequently, the Agency has advocated for “urgent action” to counteract the slowing rate of improvement observed since 2015.[9]

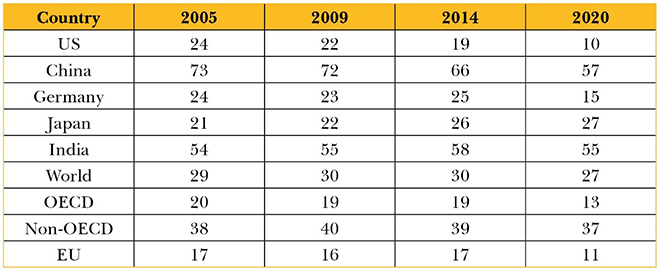

Conversely, developing countries have seen a rapid rise in energy use owing to the activity effect (see Table 1). The increase in economic activity in the developing world is also directly correlated to improvements in life spans and socio-economic progress. While energy use has approximately doubled in countries like India and China from 2005, a large share of global energy efficiency savings is also driven by technical improvements in these countries. However, in the aftermath of the 2008-09 global financial crisis, China implemented a stimulus package that “shifted its manufacturing sector to more energy intensive manufacturing.”[10] A similar trend may emerge in China’s recovery from the pandemic, that may reduce efficiency gains in the future.

Table 1: Total Energy Consumption (Exajoules)

Equity in Coal

It would appear that OECD countries have managed to cut their dependence on coal over the last 15 years quite precipitously. In particular, this seems true of countries like the US and EU members. Japan, meanwhile, is an outlier, having turned to coal to provide base-load power to substitute nuclear energy. In most years between 2005 and 2020, the fall in coal consumption in OECD countries has outpaced the decline in total energy consumption. In 2020, for instance, coal consumption dropped by around 18 percent whereas total energy consumption fell by around eight percent.

While China has begun to reduce its dependence on coal, it still accounts for the largest share of coal consumption among all nations. China is also home to over half of the world’s thermal power plant pipelines – with around 163 GW in pre-construction stage, even discounting the 484GW worth of cancellations since the Conference of Parties at Paris in 2015.[12] China is also one of the last of the biggest providers of public finance for overseas power plants with over 40GW of projects in the pre-construction pipeline.

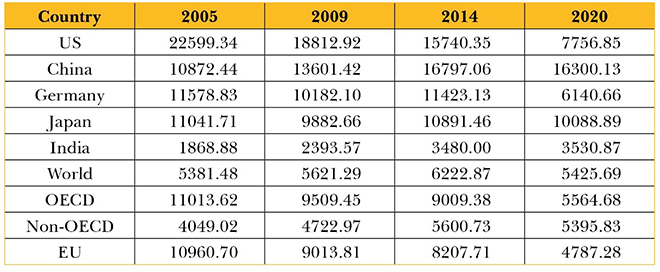

Simultaneously, coal consumption has remained relatively stable at just under 40 percent of primary energy consumption among non-OECD nations (see Table 2). In these countries, coal consumption tends to mirror total energy consumption. India’s dependence on coal has also remained unvarying. These trends suggest that non-OECD countries such as India require to do much more to contribute to a global reduction in coal consumption and therefore towards net-zero GHG emissions. However, there is more to the OECD’s reduced coal consumption than meets the eye.

Table 2: Share of Coal in Primary Energy Consumption (%)

Since the Earth Summit in 1992, India and other developing nations have argued for an equity-based approach to GHG reduction, commensurate with domestic capabilities and historical emissions. This approach has often been subject to cross-examination by OECD experts. For instance, in a 2019 report by the Universal Ecological Fund, high-profile experts including a former White House Adviser and a Harvard professor, ranked national climate commitments based on absolute emission curtailment targets.[13] The report clubbed developed and developing countries together in its assessment of the general insufficiency of climate pledges to meet the Paris Agreement’s goal to keep global warming below 1.5 degrees Celsius above pre-industrialisation levels.[14] This should not be a surprise, however, as it is only in consonance with the overall trend of Western academic discourse seeking to dilute the equity principle.

It is a principle that should not be set aside just yet, given the persistent differences in per capita fossil fuel consumption between the developed and developing worlds. Despite near doubling over 2005-2020, India’s per capita coal consumption is still below the global average (see Table 3). The global average, in turn, has remained static around this period because the decrease in the per capita consumption of coal in OECD countries has been partially offset by an increase in the per capita consumption in non-OECD countries. However, the per capita consumption of coal in OECD countries still exceeds that of non-OECD countries, despite much higher levels of wealth and, therefore, greater capability to transition to renewables and other fuels.

Table 3: Total per capita Coal Consumption (KWh)

Indeed, a large share of the decrease in per capita coal consumption in OECD countries is driven by transition to fuels such as natural gas, that are used to generate electricity, particularly in countries like the US. It accounts for around a 34-percent share of primary energy consumption in the US, and 25 percent in the EU, compared to seven percent in India (and a similar share in China). In contrast, the share of gas in India’s energy mix is among the lowest in the world. Even as Prime Minister Narendra Modi wants to more than double the contribution of natural gas to 15 percent of India’s energy mix by 2030, the Petroleum Secretary has said that the country cannot rely on natural gas.[15] There are several reasons, including high landed costs relative to coal, complex domestic pricing mechanisms, a lack of pipeline infrastructure and stable supply/ import linkages, and the inability of financially stressed electricity distributors to enter into “take or pay” contracts.[16]

India, therefore, requires relatively greater and more aggressive investments in alternative sources of energy than its developed country counterparts that have had decades to transition to fuels like natural gas. Such financial flows to India can prove to be much more effective vehicles for a net-zero trajectory, compared to similar investments in other parts of the world with higher per capita exposure to coal and relatively slower transition pathways to renewables.

Around 72 percent of India’s GHG emissions are linked to its energy sector.[17] It is clear, that if OECD countries are aiming to accelerate a global reduction in GHG emissions, they will need to help India finance its energy transition and overcome the many resource-linked barriers to the wide-scale adoption of renewables. The high costs associated with renewable energy storage and grid upgrade requirements, are related resource challenges. Since developed countries are unlikely to be satisfied with per capita equity, they would do well to help India hurdle some of its obstacles.

Financing Energy Transition

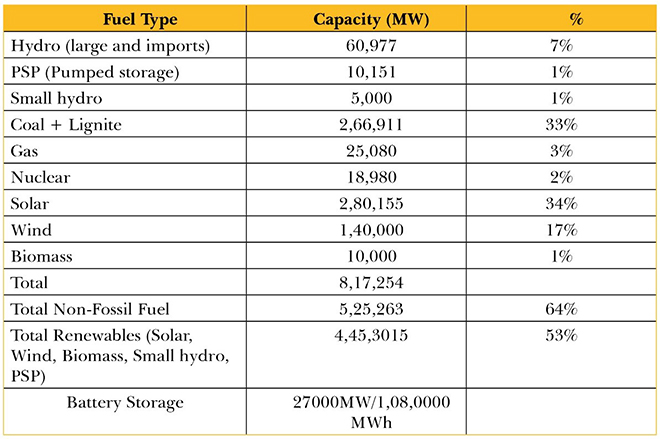

According to India’s Central Electricity Authority’s (CEA) Optimal Generation Capacity Mix, the country’s installed capacity will increase to 817 GW with an additional 27GW of battery storage, by 2029-30 (see Table 4). Of this, firm capacity will contribute approximately 395 GW while renewable sources, around 445 GW. Additionally, a July 2021 study has concluded that more efficient use of existing thermal resources could lead to 50 GW of excess coal capacity with respect to current needs of the system.[18] With limited expectations from nuclear and gas resources and deteriorating coal economics, investments in renewable energy storage options are crucial for managing India’s base load requirements. This requires unlocking of financial and technological flows from the OECD, particularly since there are several uncertainties associated with the cost of battery storage technology. These include risks linked to supply chains and exchange rates.

Table 4: Optimal Electricity Generation Mix (2029-30)

Experts point out that the more renewable energy is introduced into the grid, “the harder and more expensive it will be to use” because of inherent factors such as intermittency.[19] This will need to be offset by investments in a grid that is able to accommodate variable and increased flows of electricity across different regions. The IEA estimates that annual investments in electricity grids will need to “more than double” by 2030 in a conservative scenario where developed countries achieve net zero by 2050, China around 2060, and other emerging and developing economies, by 2070, at the latest.[20] India will also need to explore much wider scale of privatisation of state distribution companies, which now owe generators around USD 20 billion.[21]

The capacity utilisation of India’s coal assets has also witnessed a significant decline over the past decade, with power plants running at 53.37 percent plant load factor (PLF) in FY 2020-21 compared to 77.5 percent in FY 2009-10.[22] Several factors have contributed to this, including the rapidly expanding share of renewable energy generation. India’s coal story is beset with additional challenges including planned decommissioning of older coal plants (approximately 54 GW of coal plants by 2030).[23] Research indicates that the cost of retirement ranges between[24] USD 0.41 – 0.59 million per MW, with older thermal units relatively cheaper to decommission. Consequently, maintaining India’s coal fleet also requires around USD 106 million in investments, to retrofit existing thermal power plants with Flue Gas Desulphurization units. The deadline for doing so has been extended several times in the past decade and has finally been fixed for 2022 for plants located in populous areas.[25] The combination of underutilised coal plants, increasing costs of plant maintenance and reduction in costs of renewables, provides a unique opportunity to galvanise investments and strategic attention towards a low-coal pathway.

The technologies that will pave the way to such low-coal path are developing rapidly, with significant progress in renewables, battery storage, and green hydrogen, among others. They each require, however, large financial outlays. Moreover, India is still highly dependent on expensive bank lending, which is now hitting sectoral exposure limits, whereas long-term capital is required to finance energy infrastructure. As of April 2020, the exposure of banks and non-bank financial institutions to India’s power sector was already around USD 160 billion, roughly the lending necessary to finance the country’s renewable energy targets for 2030. [26]

According to the Government of India’s ‘Energy Compact’ submitted to the UN in September 2021, the country required a total investment of USD 221 billion to set up 450 GW renewable generation capacity, including associated transmission and storage systems.[27] However, other research has pegged this investment much higher at USD 661 billion, to build both renewable energy systems and transmission and distribution systems.[28] The IEA also estimates that India requires a total investment of USD 1.4 trillion for clean technologies to help achieve a sustainable development path till 2040.[29] In comparison, developed countries managed a transition away from coal over a longer period of time and with different costs. Investments for clean energy in the Global South need to be consistently and significantly higher to help achieve the simultaneous goals of SDG 7 (Affordable and Clean Energy) and other development targets.

Advanced countries would do well to recognise that long-term institutional capital is urgently required to help India transition from coal to renewables at scale. What is needed is far more than lip service; nor will change happen only through negotiations at Glasgow at the COP26. Overall, mainstream sources of international climate finance such as the Green Climate Fund and the Global Environment Facility have managed to provide just over a billion dollars in finance for national projects.[30] While there is enthusiasm around green bond financing, the absolute value of issuances towards relevant segments such as renewable energy, is still relatively low at around USD 11.2 billion since 2014.[31] To put it in context, the global issuance of green bonds totalled over USD 305 billion in 2020 alone, specifically for climate-related and sustainability projects.[32]

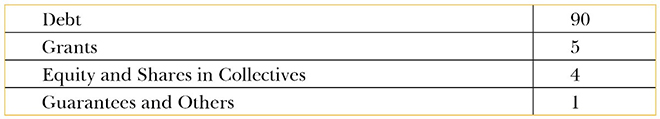

A high sensitivity to the cost of capital means that other sources of institutional capital are needed to fill the gap, even as the Indian private sector learns to raise green bonds and co-develops green taxonomies with relevant parties. Most OECD financing towards renewables in developing countries is conducted through debt instruments. According to the International Renewable Energy Agency, cumulative transactions and financial flows from the OECD countries towards renewables development in the rest of the world reached USD 253 billion between 2009-2019, of which around USD 228 billion was in the form of debt. India accounted for just under USD 11 billion of the amount, which is less than five percent of the cumulative debt finance by OECD countries.

Table 5: Cumulative Transactions by OECD Countries into Renewables (2009-2019, %)

OECD members must aim to redirect institutional investments towards India. For instance, their sovereign funds and pension funds must adjust to new business models around energy storage and distribution. There are also many possible designs of new financial instruments that could be explored. These could recognise the different capacities and capabilities in developing countries at the outset. For instance, grants and debt funding could be combined in multiple ways to subsidise loans. The scale of grant involvement could be directly proportionate to relevant environmental, social and governance factors, and therefore could incentivise more aggressive low-carbon paths. Similarly, new kinds of investment management and rating modalities could be employed to scale up investments where they are most required to offset planetary risks. The availability of innovative long-term finance for India is critical to any meaningful realisation of global net-zero ambitions. India, for its part, must bite the bullet on large-scale power sector reforms, to improve distributional efficiencies and facilitate inward financial and technological flows.

Conclusion

India’s current per capita coal consumption is three-fifths that of the OECD average, and one-fifth that of China’s. This low per-capita coal consumption in a coal-rich country can and must remain the key feature of India’s growth, going forward. This article demonstrates, that for India to keep its coal in the ground, more and better financing is needed.

A market case for a green transition in India already exists. The last few years have demonstrated India’s appetite, among the public and the political class, for a move towards cleaner growth. What it requires now is what this essay calls for: a higher flow of capital towards crucial green sectors—in particular, a higher level of foreign capital inflows towards these sectors, and a better texture of such capital, moving towards a more patient and equitable finance.

This brief was first published in ORF’s monograph, Shaping Our Green Future: Pathways and Policies for a Net-Zero Transformation, November 2021.Read More…