Lower Rates Drive Salaries for Some German Asset Managers

Job specialization is paying off.

Asset managers in Germany focusing on alternative investments are among the winners of the prolonged period of low interest rates because of their rising compensation, according to a study by Frankfurt-based head hunter Banking Consult exclusively seen by Bloomberg News.

“Low interest rates are forcing institutional investors to invest more and more in alternative investments to increase returns. The asset management industry has responded by often setting up corresponding businesses, which in turn drives demand for highly skilled professionals,” Thore Behrens, vice president of the company, said.

Examples of alternative investments include infrastructure projects and funds in areas such as transport, traffic, water, health or renewable energy, he added. In addition, they comprise private equity, private debt and real estate.

“Young experts are moving from private equity or corporate finance to the asset management industry,” Behrens said. “The battle for top talent will continue to intensify in the next few years, which will drive up salaries.” In some cases, bonus payments are already linked to the returns of alternative investments in percentage terms.

Susanne Eickermann-Riepe, partner at consulting firm PwC, confirms that real estate and infrastructure have become the focus of many investors. “It is not only because of the low interest rate environment, but also the high spread – there are not too many other attractive investment opportunities,” she said. “For this reason, the market should develop dynamically in the coming years, even if interest rates rise moderately again.”

Behrens points out that alternative investments are no longer the domain of institutional investors alone. “They increasingly attract the interest of retail investors.”

This is evident at Berlin-based Liqid, a digital asset manager for retail clients, whose customers have already invested in private equity. Other potential offerings are being evaluated. “Infrastructure and real estate investments are two of the areas we are looking at, and we may offer new asset classes as soon as later this year,” CEO Christian Schneider-Sickert said.

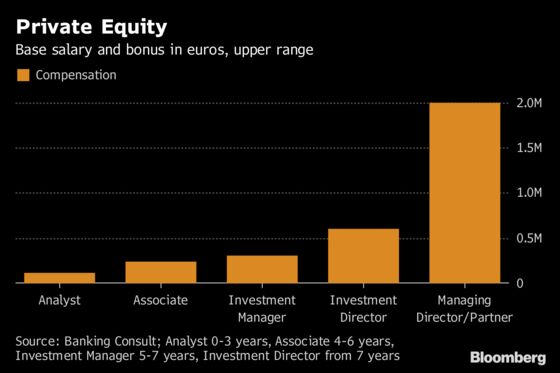

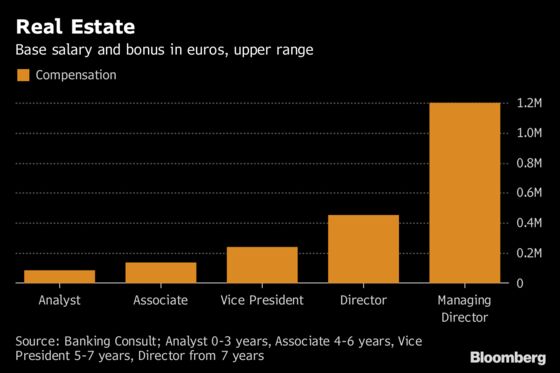

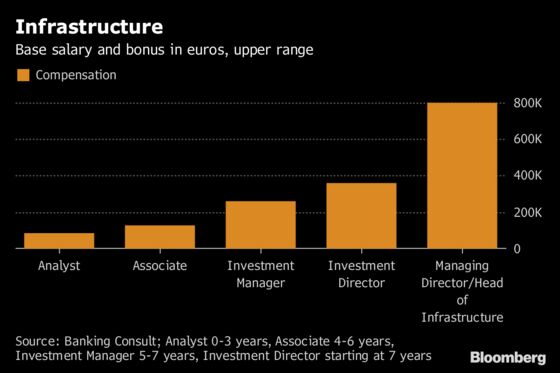

The survey by Banking Consult analyzed current compensation levels including bonuses for employees who are structuring deals around alternative investments at asset managers in Germany. It came to the following conclusions:

In private equity, an analyst at entry level is likely to get over 110,000 euros ($126,000) in base salary and bonuses per year in the upper compensation range. After seven years, the figure will be at least 210,000 euros and at best 600,000 euros. A managing director or partner may earn a maximum of 2 million euros per year.

In real estate, an employee can earn about 44,000 euros in the lower compensation range and 84,000 euros in the upper range in the first three years of the career. Someone who has risen to the rank of managing director might get between 240,000 euros and 1.2 million euros per year.

In infrastructure/asset finance, an employee earns just under 50,000 euros in the lower earnings range and almost 85,000 euros in the upper one at the beginning of a career. Anyone who has seven years or more of job experience and has the rank of investment director can expect 360,000 euros at best. As managing director, the maximum is 800,000 euros.

The study is based on specific salaries in Germany, which stem from the work of the head hunter, as well as discussions with customers and candidates.