The government has made a proposal for complete electrification of the Indian Railways over the next four years.

Mumbai: Edelweiss Infrastructure-backed Sekura Energy and CDPQ-backed China Light & Power (CLP) India are in separate talks to acquire the power transmission assets of Kalpataru Power Transmission (KPTL) in a deal worth $200 million, according to two people aware of the development.

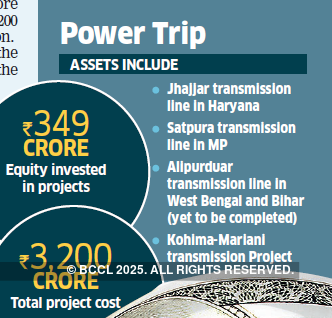

The assets include Jhajjar transmission line in Haryana, Satpura transmission line in MP, Alipurduar transmission line in West Bengal and Bihar (yet to be completed), and the Kohima-Mariani transmission project. The equity invested for the projects is Rs 349 crore while the total project cost is likely to be Rs 3,200 crore, according to an investor presentation.

“The due diligence of assets is over and the talks are in advanced stages,” said one of the persons cited earlier. However, there is a chance that the government may raise a concern over CLP buying assets in Northeast India, he said.

A spokesperson for Edelweiss Infra declined to comment while emails sent to the spokespersons for Kalpataru Power and CLP remained unanswered till press time on Sunday.

As on December 31, 2018, Kalpataru Power had an order book of Rs 14,167 crore. It had consolidated debt of Rs 3,320 crore at March-end last year.

Besides transmission & distribution, Kalpataru Power is engaged in EPC for oil and gas infrastructure and the railways, for which it does civil infrastructure, track-laying, signalling and electrification projects.

Sekura Energy is the energy-focused platform wholly owned by Edelweiss Infrastructure Yield Plus, with a focus on investing, acquiring and operating assets in the Indian power sector. In October, Sekura had acquired two operating power transmission assets from Essel Infraprojects — Darbhanga-Motihari Transmission and NRSS XXXI (B) Transmission. Sekura also acquired Essel Infra’s Warora-Kurnool Transmission and NRSS XXXVI Transmission, which are expected to be commissioned in FY20. The enterprises value of the four projects comes to $800 million (Rs 6,000 crore).

Edelweiss Infrastructure Yield Plus, registered as a Category I AIF, focuses on investing in power transmission, renewable power and roads and highways, besides other infrastructure assets. Edelweiss Alternative Asset Advisors (manager of the infra fund) had marked the first close of the infra fund in May, raising about Rs 2,000 crore. The fund is in the process of raising Rs 6,500 crore in total for the infrastructure fund.

CLP entered the Indian market in 2002 and is invested in a diversified portfolio comprising wind, solar, coal and gas assets, with total generation capacity of 1,796 MW as on Dec 31, 2018. CLP India’s assets include a 1,320MW coal-fired power project at Jhajjar, Haryana, and a 655MW gas-fired plant at Paguthan, Gujarat. Last year, Canadian pension fund CDPQ acquired a 40 per cent stake in CLP India for Rs 2,640 crore ($365 million) in cash. Parent company CLP Group retains a 60% stake in the Indian unit. Last month, CLP Wind Farms had acquired Suzlon Energy’s two arms — SE Solar and Gale Solarfarms — for Rs 99 crore.

India’s power transmission and distribution market is seeing growth opportunity following government initiatives for capacity addition. By 2022, India will need about $80 billion in investments in the transmission sector following the government’s ‘power for all mission’ and the renewable energy target of 175 GW by 2022.

The government has made a proposal for complete electrification of the Indian Railways over the next four years, reducing dependence on imported fossil fuel. This move is also expected to give a boost to the power transmission space. The majors in the T&D sector are Kalpataru Power Transmission, Cummins India, ABB India and Compton Greaves.