Sovereign wealth funds look at infra sector

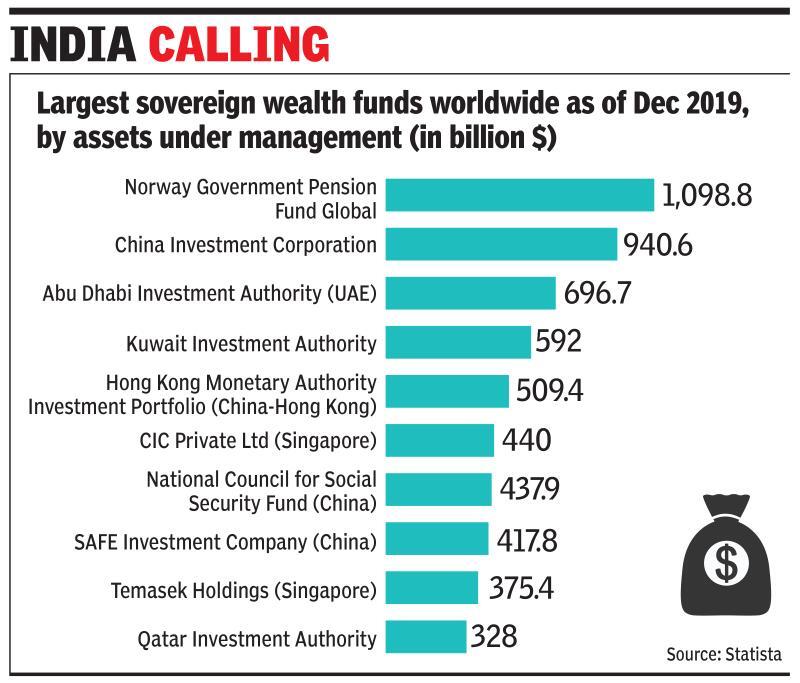

NEW DELHI: Several top sovereign wealth funds from Saudi Arabia, the UAE, Singapore and other countries have shown keen interest in investing in the country’s lucrative infrastructure sector.

FM Nirmala Sitharaman in her Budget speech had offered incentives for sovereign wealth funds of foreign governments in the priority sectors. The government said it will grant 100% tax exemption to their interest, dividend and capital gains income on investment made in infrastructure and other 36 notified sectors before March 2024 and with a minimum lock-in period of three years.

Sovereign wealth funds are created from the assets of the state and are state-owned investment funds, which invest in long-term projects to chase better returns.

The Abu Dhabi Investment Authorityhas drawn up massive plans for investment in sectors such as airports, renewable energy. Japan is also exploring channelling some investments into India.