Early-stage utility-scale projects face unprecedented headwinds, but the global market could be set for a swift rebound.

Wood Mackenzie slashed more than 20 gigawatts off its forecast for global solar deployments in 2020, as the impact of the coronavirus pandemic comes into sharper focus.

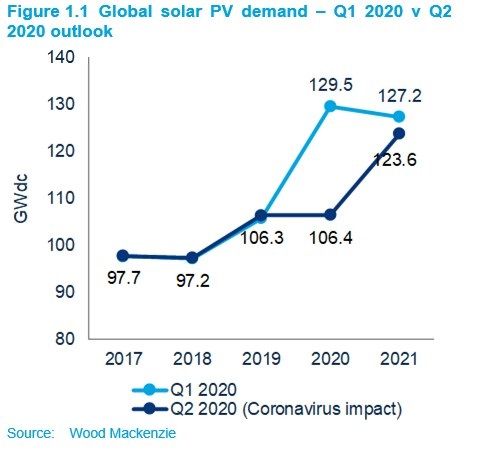

Construction is slowing, tenders are postponed, and for earlier-stage projects, there are question marks around financing. As a result, WoodMac has slashed its forecast deployment by 18 percent, from 129.5 gigawatts to 106.4 gigawatts.

“Auctions are being delayed, [power-purchase agreement] negotiations [have been] halted and permitting is slowing down,” Tom Heggarty, principal analyst for solar at Wood Mackenzie, said in a statement. “Weak power prices and collapsing [forex] rates are severely damaging the economics of new investments across a wide range of countries. Projects that were slated for 2021 will be tougher to bring to market on time, if they make it at all,” he said.

WoodMac’s forecast for next year has been reduced 3 percent, from 127.2 gigawatts to 123.6 gigawatts.

“Although we expect a strong economic recovery next year, projects that should be delivered in 2021 are being developed and financed today. When the recession hits, not all activity will go ahead as planned,” he warned. A chunk of the coronavirus pandemic’s impact on next year’s deployment will be offset by projects originally scheduled for this year being shunted into 2021.

Delayed projects pushed into 2021 will cover up some of the losses then. (Credit: Wood Mackenzie)

Recession and response

The overriding risk for solar is the anticipated global recession. Wood Mackenzie assumes global GDP will shrink by 2 percent this year. The U.S. experienced a drop of 2.5 percent in 2008 during the Great Recession.

Residential and commercial installs are expected to be hit particularly badly as discretionary spending is cut.

“One risk to the upside, however, will be the reaction of policymakers. The stimulus taps have already been turned on, and no doubt there’ll be more to come as the immediate challenges posed by coronavirus fade and attention turns to the recovery,” said Heggarty. “If — and it’s a big ‘if’ — post-coronavirus spending is directed towards decarbonization efforts, solar PV could stand to benefit. That’s something we’ll be watching closely as we move through 2020.”

The European Union has already stressed that any stimulus must be aligned to its broader objectives, including the green energy transition. The next seven-year budget has yet to be agreed upon, and any progress made thus far was done so in the absence of COVID-19 considerations.

The U.S. did not include any provisions for renewables in its own stimulus packages released to date. There have been calls for the sunsetting federal Investment Tax Credit (ITC) for solar to be extended beyond the end of the year.

A low like no other

The solar industry is well accustomed to cycles of boom and bust. Module prices were held artificially high in many markets during the last decade of transcontinental trade wars between China, the U.S., the EU and India took hold. China’s dominant position upstream and downstream has meant fluctuations in its domestic deployments have had outsize consequences elsewhere. Cuts — especially retroactive cuts — to subsidy support programs have sent markets into a tailspin.

But the coronavirus pandemic and the coming recession are something else.

“The difference here,” Heggarty told GTM, “is that it impacts the entire global market at the same time. Everything that we have seen affecting the PV market in the past has in some way been localized, not the entire market and across all sectors. This is a pretty unique set of circumstances.”

Ultimately, the global solar market looks well positioned to ride out even this storm. Around 60 percent of the supply chain is concentrated in China, and early signs suggest the country has gotten over the worst of the disease outbreak. Heggarty does not foresee any major supply-chain issues beyond localized logistics bottlenecks.

“There will be modules available. There will be inverters available. That won’t be a problem on a global basis,” he said.

Meanwhile, the trend for decarbonization is likely to remain unscathed, and solar is unlikely to be knocked off its cost curve.

“Solar [projects are] pretty quick to develop and construct. So once we start to see restrictions lifted, the industry should, theoretically, be in a good place to bounce back quite quickly,” said Heggarty.