Court Ruling Clears Way For Energy Storage On The Grid. Who Benefits?

The way has been cleared for energy storage projects by a federal appeals court. The July decision is a big win for independent, merchant battery companies and renewable energy proponents.

Advanced battery technologies and decreasing battery costs have encouraged the development of utility-scale (really big) electricity storage stations on the grid. Tesla -3.8%TSLA and AES Energy Storage have led the way with two such batteries. These address the greatest handicap wind and solar energy have in their push to eliminate fossil fuels from the generation market: intermittency. Batteries will also solve a second limitation of wind and solar energy, that peak renewable energy production is not always coincident with peak demand. Electricity demand varies over a day and over a season. It is this peak-and-trough wave that energy planners want to address with electricity storage facilities.

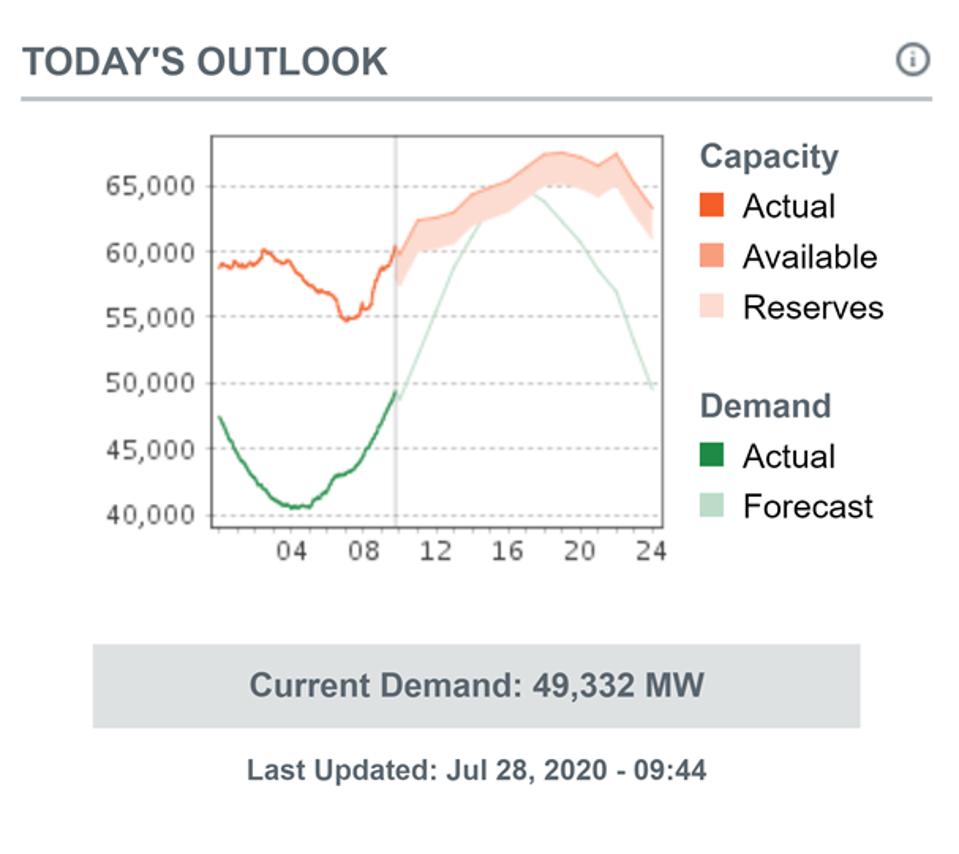

Today, most markets require electricity generation fleets sized to meet demand on the hottest day in August or coldest day in winter. Using the Electricity Reliability Council of Texas, ERCOT, market as an example, peak demand is forecast to reach 75,000 megawatt hours (mWh) in August 2020. ERCOT is charged with making sure that there are sufficient supplies. However, the average electricity demand in ERCOT throughout the year is approximately 45,000 mWh. Battery storage would help reduce the need for a portion of the generation fleet and hasten the retirement of older high-cost generators.

Hydroelectric power stations have addressed the ebb and flow of electricity demand by pumping water back into reservoirs, using excess electricity to turn generators into pumps. When demand rises during the day, the pumps reverse again to provide electricity. The mammoth Oroville Dam is an example. Of the six generating turbines, two can be reversed to pump water back up into the reservoir.

Buy Low. Sell High.

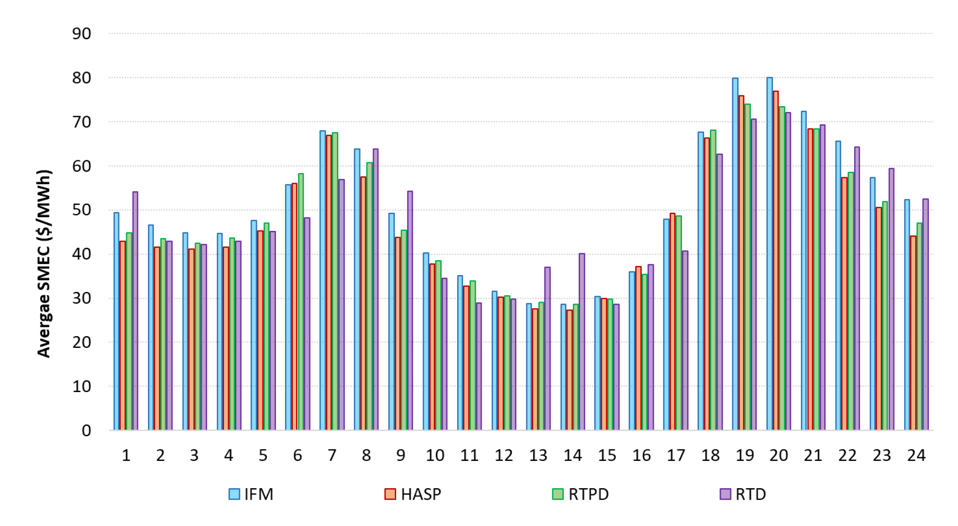

Battery stations can buy low-priced electricity from the grid at night and sell it at higher prices during the day. In Texas, where the wind powered electricity frequently drives prices negative, a battery facility could be paid to take electricity at night. Under that situation, a battery plant operating margin would be much larger than any generator on the grid. Will the margin provide enough profit to pay for the capital cost of batteries? The answer appears to be yes, judging from the fight generators and transmission companies have waged to prevent wholesale market access for batteries.

Entrenched legacy generators have worked to stall independent battery stations by complaining that these are not generation facilities and cannot perform the same way as a legacy generation station on the grid. In particular, they were concerned that their own electricity would be used against them—bought low and sold high the next day while depressing prices. The legacy plants would lose both ways! Nonsense.

While ERCOT and the Public Utility Commission of Texas have obligingly dithered over battery access to their grid, utilities across the nation challenged FERC in court on essentially the same matter, arguing that in Order No. 841 FERC overstepped its jurisdiction into local markets by “barring States from ‘broadly prohibiting’ local [Electricity Storage Resources] from participating” in the electricity markets. The U.S. Court of Appeals for the District of Columbia Circuit confirmed FERC’s jurisdiction over federal wholesale markets thereby slamming shut a backdoor approach to banning battery storage.

The federal court ruling and recent pronouncements from the Public Utility Commission of Texas clear the decks for battery packs to take advantage of the price cycling through a day. On the competitive landscape, the question is will the legacy utilities embrace batteries or allow their market share to be eroded further by entrepreneurs and renewable energy generators.