Solar and wind have struggled to compete against a flood of cheap natural gas in the largest U.S. wholesale power market, operated by PJM.

Interconnection queue requests across all the major North American markets show that over 90 percent of new requests now consist of solar, wind and storage. This is the result of state-level policies and declining costs.

Even in PJM, where natural gas has dominated the generation queue, new requests are now giving way to wind, solar and battery storage projects. (PJM is the country’s leader for front-of-the-meter storage, though it will likely be overtaken by California in 2020.)

However, as utilities replace retiring coal assets in PJM, coal capacity has been replaced at almost a one-for-one rate with new combined-cycle natural-gas generation. Over the last several years, 29 gigawatts of retiring coal plants in PJM have been replaced with 23 gigawatts of natural gas, according to a recent Wood Mackenzie Power & Renewables webinar.

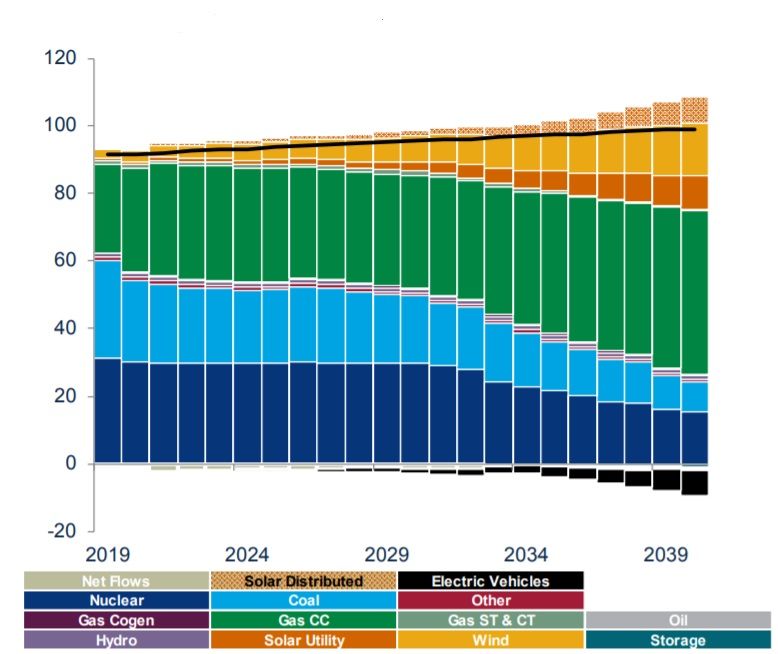

PJM Generation Outlook (GW)

Source: Wood Mackenzie Power & Renewables

PJM’s natural-gas plant building boom has been centered in northeast Pennsylvania, with additional recent activity in southwest Pennsylvania, West Virginia and eastern Ohio, near natural-gas resources. Operation costs are low and gas supplies plentiful, driving the cost of electricity down.

Because of this plentiful natural gas, wind and solar are not yet competing with natural gas on price in PJM when it comes to replacing coal. Wood Mackenzie’s analysts contrasted PJM with Texas’ ERCOT territory, where wind and solar dominate the generation queue.

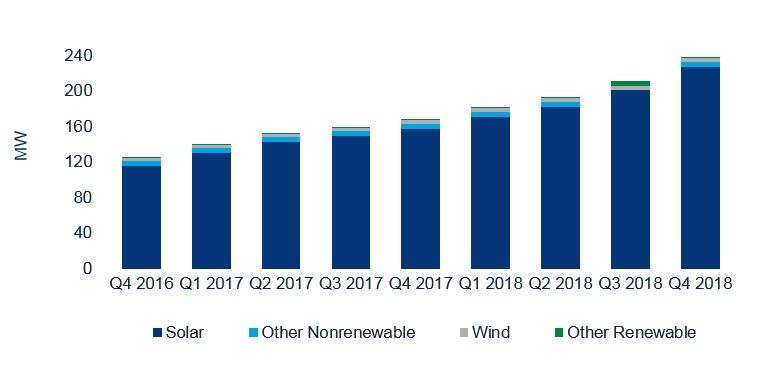

In ERCOT, plenty of coal plants have been retired, including 4 gigawatts in 2018 alone. Prices in ERCOT’s energy-only market are not consistently high enough to make the market attractive for new natural-gas development. Wind and solar are picking up the slack; even small solar installations under 1 megawatt have flourished, nearly doubling capacity in just two years from 2016 to 2018.

Distributed Generation Under 1 MW, Q4 2016-Q4 2018

Source: Wood Mackenzie Power & Renewables

With PJM’s natural-gas boom in full swing, will the region be locked into natural-gas generation for the lifetime of today’s new plants?

Wood Mackenzie analysis for 20 years out suggests gas will continue to make up around 40 percent of the generation mix, barring dramatic changes to how the energy mix is determined. Resources still must compete in an open market, and PJM holds a forward capacity auction three years in advance. (This year’s 2022/2023 Base Residual Auction will be held in August 2019.)

While front-of-the-meter renewables struggle to gain ground relative to natural gas in PJM due to low prices, one area to keep an eye on is flexibility and distributed energy resources in PJM. Organizations like the Solar Energy Industries Association argue that to level the playing field in PJM, grid operators will need to evolve power markets in order to take advantage of “inverter-based resources.”

Recent developments have shown what’s possible, as changes to wholesale markets are poised to bring more storage and DERs into the mix in the independent system operator and regional transmission organization footprints. FERC Order 841 has nudged market operators to take a closer look at storage, although the commission still has to rule on the pending DER proceeding.

***