Patience pays off as world’s biggest solar contractor takes leading position in Australia

Indian solar contractor Sterling and Wilson insists it was not focused on market share when it first looked at the Australian solar market nearly six years ago. But it didn’t really matter – the fierce competition amongst a host of new players resulted in most of them either collapsing or beating a rapid retreat.

Sterling and Wilson took a wait and see approach for several years, but now it stands as the biggest EPC contractor left in the market. It has recently signed up to build what will be the country’s biggest solar farm – the 400MW Western Downs solar project owned by Neoen in Queensland – and says margins have rebounded significantly as the level of competition recedes.

It didn’t always seem that promising. Vikas Bansal, the company’s head of international business development, remembers landing in Australia for the first time in 2014, only to wake up the next day to learn that then Abbott government had announced a review of the renewable energy target. That review led to a near three year investment drought in large scale renewables.

It was not until 2018 that Sterling and Wilson got busy with its Australian strategy, buying a small company in Perth, GCO Electrical, to help it understand the local landscape.

“This industry has a lot of complexities and challenges,” Bansal told RenewEconomy in a phone interview. “You need to be have a local presence to underststand the market.”

But having local knowledge was not enough to save some of the biggest contracting companies in Australia, who flocked to the rapidly growing solar industry in the hope of making big dollars. RCR Tomlinson collapsed under the weight of cost over-runs and delays at more than 12 of its projects, while its biggest competitor Downer also suffered, and spectacularly withdrew from the market last year.

Decmil has also withdrawn from EPC deals and is battling over losses at the big Sunraysia solar farm in NSW. Greek-based Biosar has also exited the Australian solar EPC market.

“There were a lot of locals in the market, which were great companies, but they misunderstood the solar market, because they were not solar EPC experts,” Bansal observes.

“They unknowingly miscalculated the risks of building the solar plant. They went out of business. They didn’t do very well.”

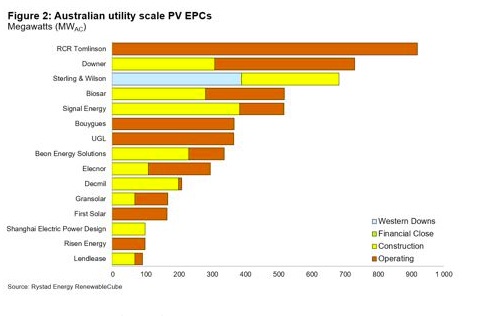

That has left Sterling and Wilson as the biggest remaining utility-scale solar EPC left in Australia, according to industry analyst Rystad Energy, which provided the table above. Apart from the Western Downs project, Sterling and Wilson are also building the 174MW Wellington solar farm for LightsourceBP in NSW, and the 120MW Gangarri solar farm for oil giant Shell in Queensland.

“Previously Sterling & Wilson was only surpassed by two players, RCR, which went bankrupt in 2018, and Downer, which has exited the utility PV EPC market,” Rystad notes. “Biosar followed Sterling & Wilson in fourth place but announced their exit from the market this year, leaving Signal Energy– previously the fifth largest utility PV EPC player in the country – as the only competitor.”

This has had a positive spin-off for those left in the market.

In a recent conference call with analysts after the company’s annual results were posted, CEO Bikesh Ogra said the dwindling numbers of EPC players in the Australia market meant that Sterling and Wilson were seeing “good margins”, better than in other international markets

Ogra also cited “a couple of Spanish companies who are also present in those markets and who had quoted certain price, who have not understood the landscape properly and they had to wind up the business subsequently.”

He added: “The Australian market has seen a lot of churn in terms of the EPCs coming in, they are quoting very-very low prices and then burning their fingers and even shutting down their businesses.

“So what we have done is, we have used a wait and watch approach in those markets like Australia. And a couple of them went burst and you must have read them also, it opened a space for us and also opened a space for us to get a better return in terms of the margin profile.

“And the project that we are executing in Australia, are far better in terms of the margin profile that we are getting because of a limited competition that we have.”

The company is also targeting the O&M (operations and maintenance) market, which has EBIT margins of 35 to 40 per cent. On top of the recent $525 million contract to build Western Downs, it has landed a $100 million contract for O&M for that project.

Ogra also noted the falling cost of solar power in the Middle East, which he put at around Rs. 1.20 ($A21) per megawatt hour. That compares to more than Rs 2.0 for the cost of coal power plants. “So it is a no brainer that the governments would want to adopt this (solar) policy, because it is cleaner and the second it is more sustainable commercially,” Okra says.

Australia only accounts for around 6 per cent of the company;’s large scale solar projects by value – India and the Americas contributed about 27 per cent each last year – but it sees great potential.

Bansal says the market has definitely changed over the last two years, and looks promising thanks to the activities of state and local region, particularly in NSW with the development of major renewable energy zones.

“There were nine or 10 major players active in the market and some of them were really aggressive. We couldn’t match that,” Bansal said, noting that it lost out in 1.5GW of large scale solar tenders because its price was too high.

“Right now, it is an efficient market , there is a good balance of risk between solar developers and the EPC. It is better than what it used to be.

“The Australian market cannot afford to lose any more EPCs,” he says. “We call on all stakeholders that they should accept right amount of risk – to ensure that the market remains accessible – we all have to act in a way that doesn’t eat up the market or destroy the major stakeholders in the market.”

Giles Parkinson is founder and editor of Renew Economy, and is also the founder of One Step Off The Grid and founder/editor of The Driven. Giles has been a journalist for 35 years and is a former business and deputy editor of the Australian Financial Review.