Solar Inverter Market Reached Record Highs in 2019

A new report highlights the stepdown of the ITC and the rise of the inverter replacement market in Europe.

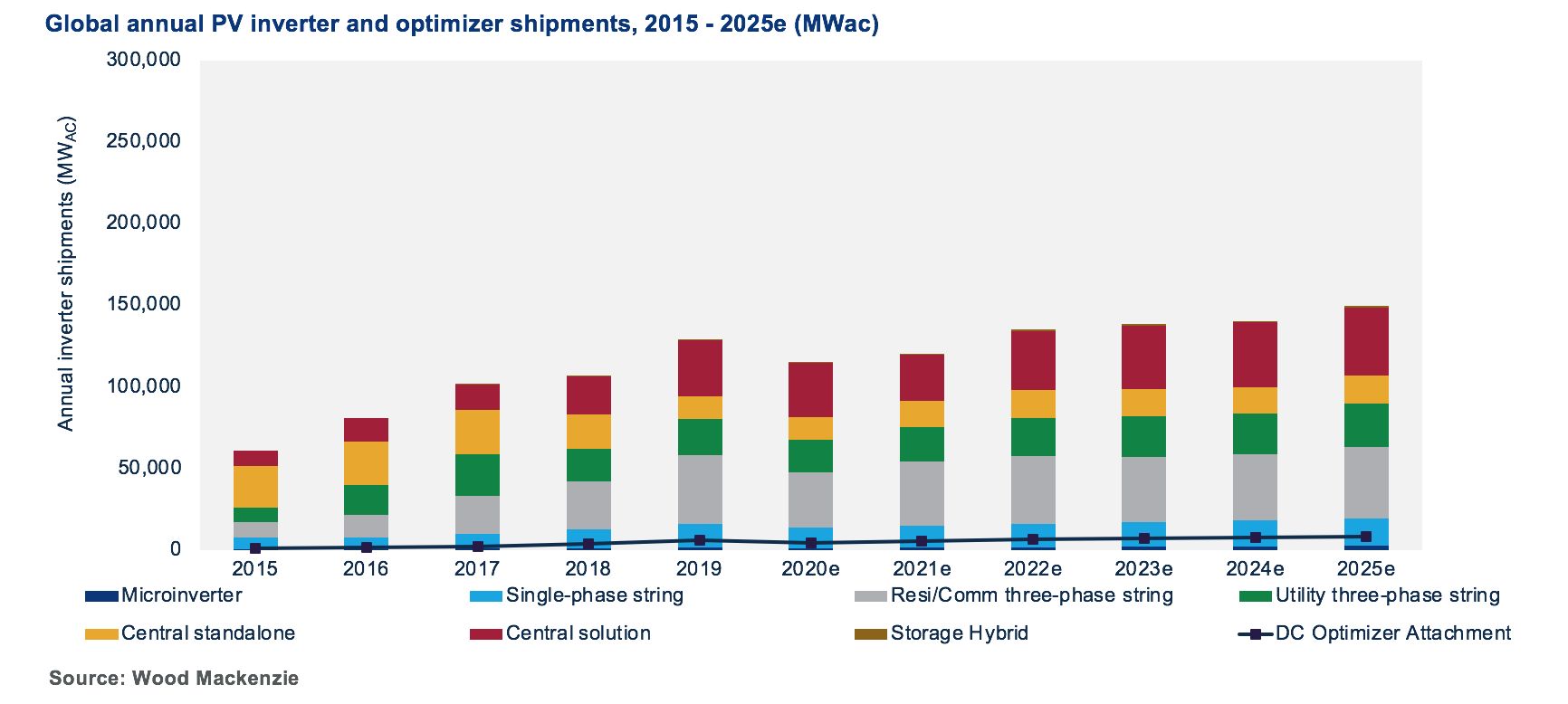

The global PV inverter and module-level power electronics market crossed the threshold of $9 billion in value for the first time in 2019. Inverter shipments also hit a record high last year, falling just short of 130 gigawatts, according to a new analysis of the inverter market from research firm Wood Mackenzie.

In addition to growing global solar installations, two factors propelled the inverter market to record highs in 2019: the rush to secure solar equipment before the stepdown of the U.S. Investment Tax Credit from 30 percent to 26 percent and the growing inverter replacement market in Europe.

While pre-purchasing solar PV modules was developers’ preferred method of qualifying for the ITC, some chose to safe-harbor PV inverters, albeit at a lesser rate. In 2019, between 25 and 30 percent of U.S. PV inverters shipped were purchased for safe-harboring purposes.

Developers chose to safe-harbor inverters for a few reasons. First, while modules made significant efficiency gains over the last several years, with more improvements on the horizon, inverters are not likely to make significant gains in the near term, and so they are perceived to have a lower technology risk than modules. Second, inverters represent a smaller proportion of the total cost stack, meaning that inverter price declines will be less valuable on a dollar-per-watt basis compared to module technology.

In Europe, the solar market took off in the late 2000s and early 2010s. Now, 10 years down the line, inverters are starting to reach their end of life, and many will require replacement. In the near term, Germany, Spain and Italy will lead the way for Europe’s inverter replacement market, while the Asia-Pacific region will begin to pick up in the next few years, particularly Japan, Australia and China.

The impact of COVID-19 on the inverter market will be minimal

The COVID-19 pandemic will not have as serious implications for the inverter industry as it has had for the broader solar industry.

The inverter market’s more-diverse supply chains helped dampen the impact. Some facilities adapted their manufacturing practices to meet pandemic-related safety guidelines; other facilities that already use automation were less affected than were those that rely more heavily on manual labor.

The pricing implications of the pandemic seem to be minimal. Logistical issues with shipping may increase costs slightly, as will the costs of personal protective equipment and safety protocols that have been instituted in facilities.

Overall, the coronavirus pandemic is expected to reduce inverter shipments in 2020 by 14 percent compared to pre-coronavirus expectations.

Chinese inverter vendors continue to grow their global footprint

Chinese inverter manufacturers expanded their overseas presence, growing from about 30 percent of global shipments outside of China in 2018 to around 40 percent in 2019. China’s market downturn and growing international demand have prompted great success for these companies.

Chinese inverter companies are typically more price-competitive than European companies and have increased price pressure globally. As a result, the market has seen a notable degree of consolidation.

Since the acquisition of ABB’s inverter line by Italian firm Fimer was announced in the summer of 2019, there has been little news of mergers and acquisitions or exits in the inverter space, but that may soon change. Price pressure coupled with the market downturn caused by the pandemic could lead to more exits and acquisitions within the next year.

Software and services

As was the case in 2018, inverter vendors continued to expand their software and service offerings, becoming more than just pure-play manufacturers. Vendors have launched internet-of-things platforms, delved into artificial intelligence and machine learning, and ventured into other smart-energy verticals. These moves can open up additional revenue streams and help companies differentiate themselves from the pack.

Reliability and customer attention are top priorities when it comes to selecting inverter technology, and vendors have reacted to meet these considerations. Recently, Enphase launched an online store to connect more directly with clients. CPS America announced it was offering inverter operations and maintenance services to those sites using its inverters, as well as sites that use inverters from manufacturers that have exited the space. And SMA launched its repowering business in early 2019.

What’s next for the inverter industry?

While the coronavirus pandemic will dampen the inverter market in the near term, the overall trend for the inverter market is positive. Demand for inverters will be on the rise as installations continue to grow globally, and as systems age and more replacement inverters are needed.

As the industry focuses on digitalization and customer needs, inverter players will be pushed to innovate and branch out into nontraditional pure-play manufacturing.